Define Assessment year and Financial year

Each tax payer is required to file an income tax return every year. This is done to maintain the records of income generated and spent by every individual. ITR filing isn’t something that can be done at any given time.

Here are the roles for the assessment year and the financial year. Two different approaches in the field of taxation, which often gets confused. Let’s get into a deeper understanding of assessment year and financial year.

What is a financial year?

As mentioned above, income tax is the tax that is levied on the total income that is generated by an individual over a year. This year does not specify the start and end dates of a normal year.

The financial year begins on April 1st and ends on March 31st of the following year. The income earned during this period is accounted for in the ITR filing. In other terms this is also called “Fiscal year”.

Every small purchase or income spent in the financial year should be recorded for future tax filing. The money is refunded by filing ITR when the income generated for that particular financial year is less than the tax paid.

What is an assessment year?

Assessment year is entirely different from financial year. This is the time period when tax payers, chartered accountants file income tax through the income tax department's portal. The deadline is usually July 31st of the assessment year.

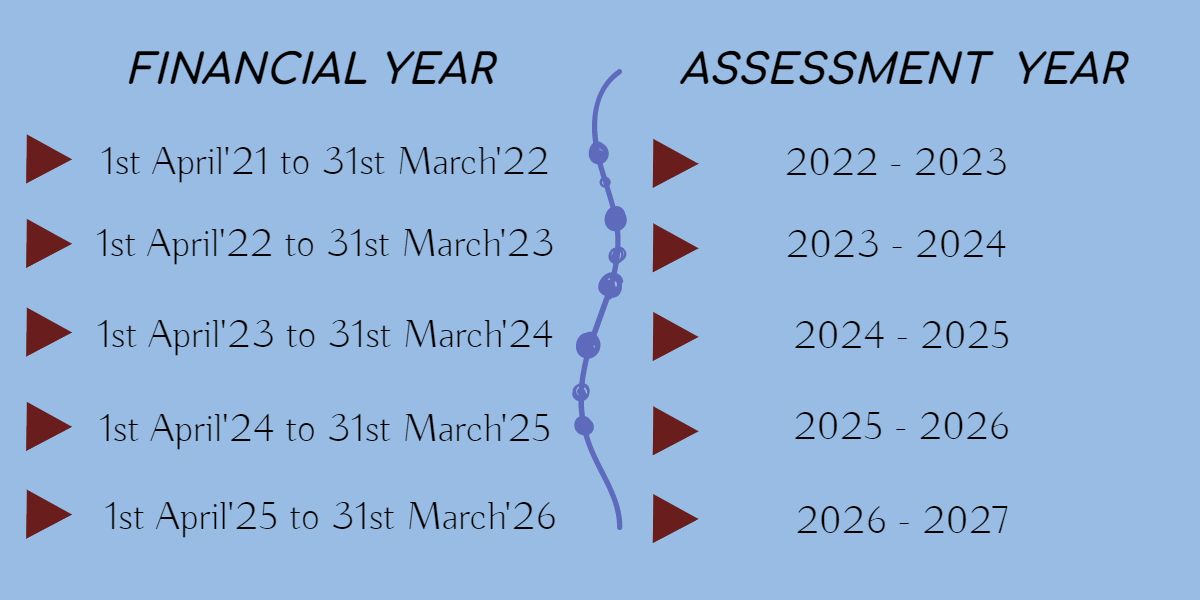

In order to file a tax return, it must be based on the total income and expenses during the financial year. When the financial year is from April’22 to March'23, the filing of income tax occurs in the assessment year 2023 to 2024.

Why does confusion arise?

The main reason behind confusing the financial year and assessment year is due to the fact that both are at the same time periods, i.e., from April 1st to March 31st. The difference is that, they occur at different years.

Another important aspect is that the income earned during a particular year cannot be reported the following year. The entire time period has to be assessed and documented, which is then filed the following year.

What is a previous year?

Nothing to worry about or get confused about. In accounting terms both financial year and previous year mean the same.

During assessment year, the financial year precedes the assessment year, so it is common to refer to the time period as previous year.

In more general terms, the current year during which the tax is filed is called the assessment year. The year when income is generated is called the previous year.

Difference between Financial year and Assessment year:

Although the two time periods are different, tax payers tend to confuse the terms. So let us distinguish between the two terms clearly.

- Financial year is the time when an individual generates income and assessment year is the period when the income is assessed and filed for tax to be levied.

- Because the income is generated during the financial year, it is not possible to estimate or calculate the cash flow for the current year. Assessment year is the following year, which is when the total income earned is assessed and filed.

- When an individual wants to reduce or make changes in the overall tax amount that is payed, then the income generated during the financial year can be altered. But at the time of the assessment, no changes or alterations can be made.

- Assessment period is when all types of tax payment, tax filing and return filing is done, based on the financial year.

Conclusion:

Financial year and Assessment year are something that is followed universally over the country. All businesses, companies even individual employees follow the same assessment and income period.

When the income is earned in a particular year, it is mandatory to file and evaluate the tax the following year. This difference between filing and earning is what is being specified by both assessment and financial year.

Frequently Asked Questions

Each tax payer is required to file an income tax return every year. This is done to maintain the records of income generated and spent by every individual. ITR filing isn’t something that can be done at any given time.