- 1. What are offline tools?

- 2. Offline Returns Tool

- 3. Tran-1 Offline Tool

- 4. Tran-2 Offline tools

- 5. ITC-01 Offline Tool

- 6. ITC O3 Offline Tool

- 7. ITC-04 Offline Tool

- 8. GSTR 4 Offline Tool (Annual)

- 9. GSTR 7 Offline Utility

- 10. GSTR 8 Offline Tool

- 11. GSTR 9, 9A & 9C Offline Tool

- 12. GSTR 10 Offline Tool

- 13. GSTR 11 Offline Tool

- 14. Matching Tool

GST Offline Tools: An Overview

GST is now familiarized with everyone now, so are the procedure for new registration, filing GST and so one. This convenience is because, the process is made easy through online.

GST portal offers all services in just few steps. All you have to do is enter the website and choose the option that you want to proceed with. What if online services are not available for certain taxpayers?

Not to worry, the council has also got offline tools to help us with GST services. In this article we will be looking about what are the offline tools available in GST portal.

1. What are offline tools?

There are list of activities involved with GST, like registration, filing, return and much more. Generally these activities can be performed easily through the online portal.

But still offline tools for the same activities are also available. All you have to do is download the tools, fill it and upload it in the portal to complete the process. In places with limited internet connection, these offline tools can be of great help.

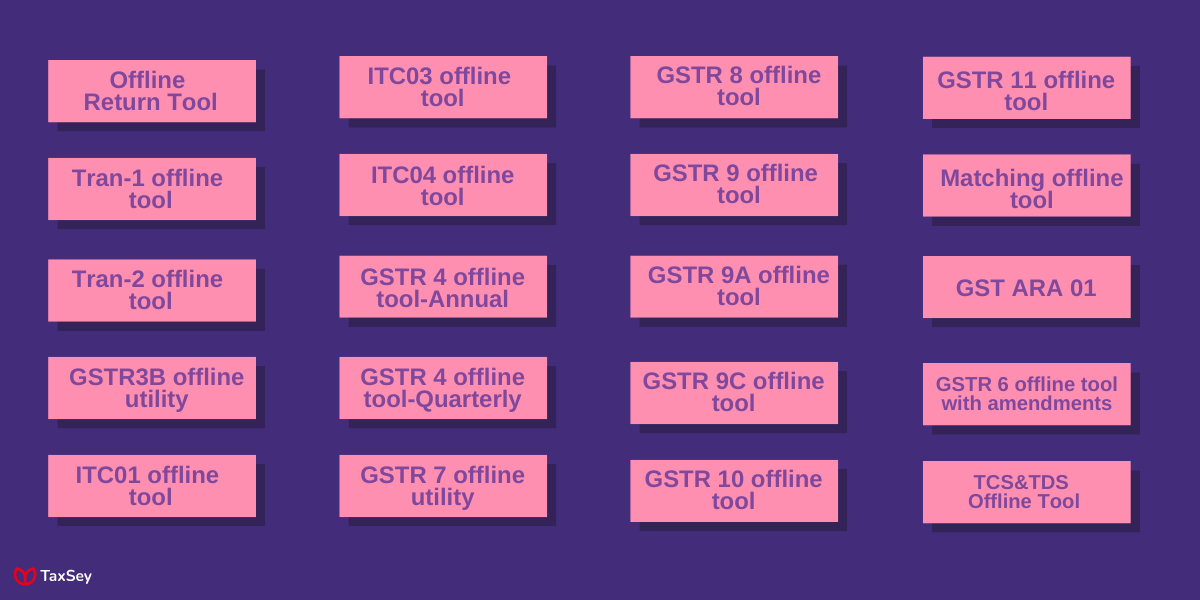

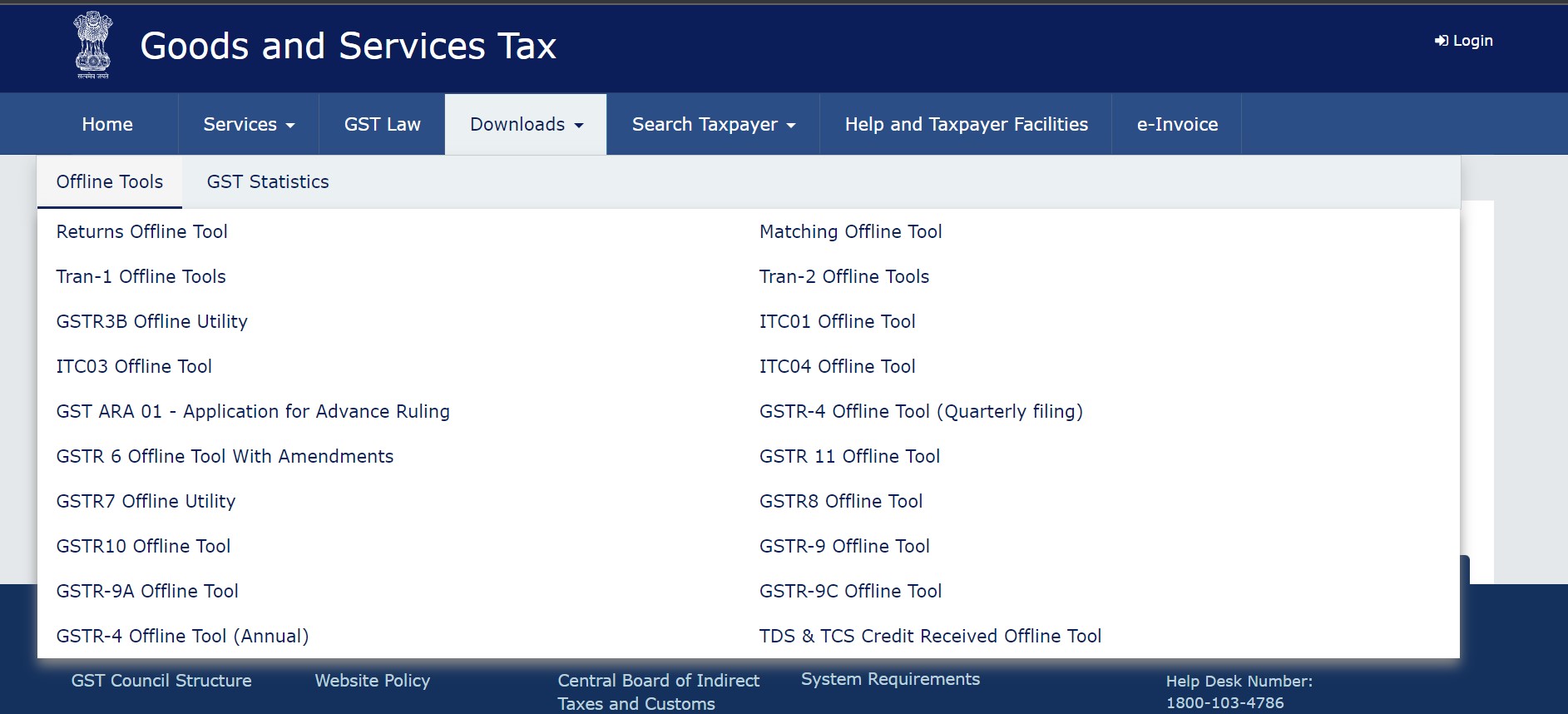

When you visit the GST portal, you can find a list of offline tools.

- Returns offline tool

- Tran-1 offline tool

- Tran-2 offline tools

- GSTR3B offline utility

- ITC01 offline tool

- ITC03 offline tool

- ITC04 offline tool

- GST ARA 01 - Application for advance ruling

- GSTR 4 offline tool (Annual)

- GSTR 4 offline tool (Quarterly filing)

- GSTR 6 offline tool with amendments

- GSTR 7 offline utility

- GSTR 8 offline tool

- GSTR 9 offline tool

- GSTR 9A offline tool

- GSTR 9C offline tool

- GSTR 10 offline tool

- GSTR 11 offline tool

- Matching offline tool

- TDS & TCS credit received offline tool

2. Offline Returns Tool

This GST return offline tool is launched in a trial basis, to make the filing procedure easier. The tool can be downloaded from the official GST website and it comprises of,

i. Form GSTR - 1 (Normal) ii. Form GSTR - 2 (Sahaj) iii. Form GSTR - 3 (Sugam) iv. GST ANX 1 and GST ANX 2

When the file is downloaded it contains the following components,

- GST offline tool - application

- Section wise CSV tools

- GSTR 1 and GSTR 2 excel workbook template

- User manual

- Readme

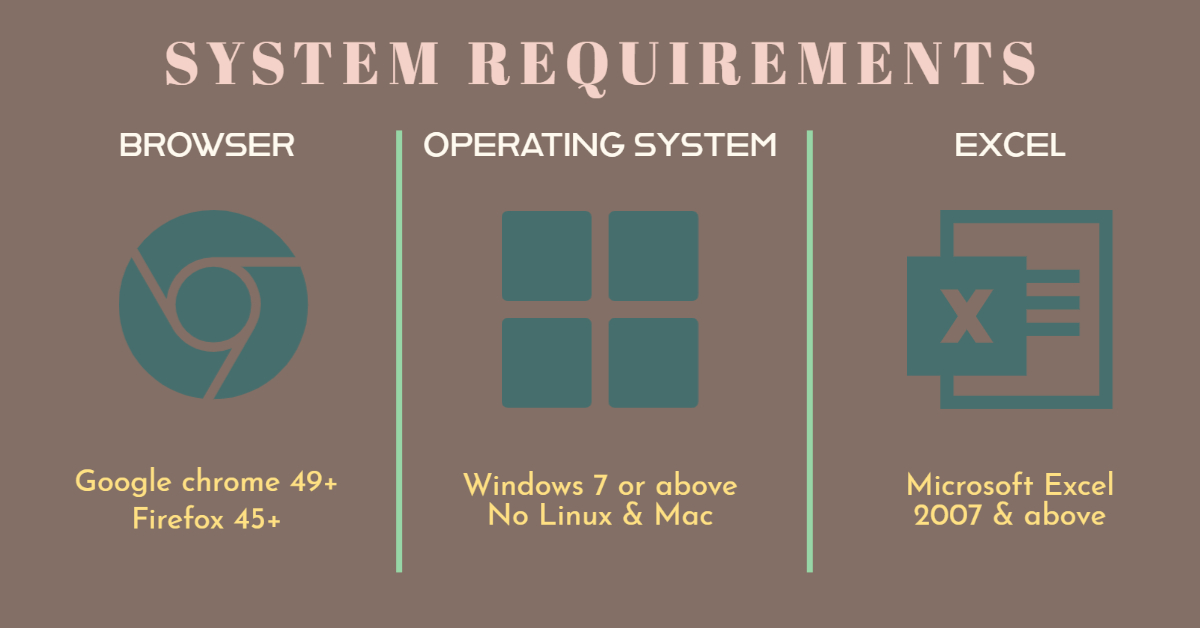

Considering the system requirement for effective functioning of the tool,

Operating system: Windows 7 or above. Linux or Mac doesn’t support this file.

Browser: Google Chrome 49+ or Firefox 45+

Microsoft Excel: Version 2010 or above

3. Tran-1 Offline Tool

Tran-1 or Transitional 1 tool is also referred to as the Stock statement. This is an Input Credit Tax tool, where the taxpayers eligible for ITC in GST can fill the form to deduct their GST amount.

Tran-1 tool has got various links to download the file

- Tran-1 (5b) statutory form CSV template

- Tran-1 (6a) Capital goods - Central tax EXCEL template

- Tran-1 (6b) Capital goods - State/UT tax EXCEL template

- Tran-1 7(a) Details of inputs held in stock or inputs contained in semi-finished or finished goods held in stock EXCEL template

- Tran-1 7(b) Details of the inputs held in stock - Eligible Duties and taxes/VAT/[ET] EXCEL template

- Tran-1 9(a) Details of Goods - Sent as Principal CSV template

- Tran-1 9(b) Details of Goods - Held in Stock CSV template

The purpose of the tool is to change the businesses VAT liability to State/Central GST. The tool gets downloaded as a zip file, which is filled and should be uploaded in the .Json format (JavaScript Object Notation format).

4. Tran-2 Offline tools

Tran-2 or the Transition 2 is filled when the tax inputs paid doesn’t have any bills or invoices. Generally this happens, when non-GST registered vendors, supply goods or services to GST registered companies.

The tran-2 tool has got two component links,

- Tran-2 inputs held on stock (central) EXCEL template

- Tran-2 credit on state tax on the stock EXCEL template

Similar to tran-1 offline tool, this is also downloaded and uploaded in .JSON format. GSTR3B Offline Utility

GSTR3B form has to be filled every month along with the filing of GSTIN. This is a self declaration form that has to be filled by every GST taxpayer.

GSTR3B forms contains information such as,

- Outward and Inward supplies liable to reverse charge

- Inter-state supplies by unregistered vendors

- Input Tax Credit information

- Exempt supplies, non-GST inward supplies

- Interest and late fee details

Operating system: Windows 7 and above

Microsoft Excel: Version 2007 or above

5. ITC-01 Offline Tool

ITC-01 is filled when the registered GST taxpayers wants to claim ITC (Input Tax Credit) under Section 18(1) of GST Act. This form is a declaration that has to be filled within a time period of 30 days to avail ITC.

The ITC can be claimed on the inputs held in stock or the inputs containing semi-finished and finished good that are held in stock.

Steps to fill ITC-01 form:

- Download the ITC-01 form, from the official GST portal.

- Check if the file is corrupted and go through the readme document before proceeding.

- Edit the file with the appropriate details.

- ITC-01 EXCEL is created, even when internet connection is not available.

- Convert the file to .JSON format and upload it in the GST portal.

Operating system: Windows 7 or above. Linux or Mac doesn’t support this file.

Browser: Google Chrome 49+ or Firefox 45+

Microsoft Excel: Version 2010 or above

6. ITC O3 Offline Tool

This form is filled in accordance to avail ITC under composition scheme for registered GST taxpayers. The goods and services under ITC are entirely exempt supplies of GST.

The downloaded file contains,

- ITC-03 EXCEL

- Readme

- Release note

The procedure for filling ITC-03 and the system requirement are similar to ITC-01 offline tool.

7. ITC-04 Offline Tool

ITC-04 offline tool is kind of a declaration form that is filed by GST registered companies. The purpose of the tool is to show details related to the inputs or capital goods that is received from a job worker. This tool can be used only when,

- Manufacturer sends goods to a job worker.

- The goods are sent back to the manufacturer from the job worker.

- One job worker sends goods to another job worker.

- Job worker sends goods directly to his end customers.

This tool also helps to upload bulk invoices and other details to GST portal. The procedure of uploading ITC-04 form and the system requirements are same as that for ITC-01 and ITC-03.

The contents of the ITC-04 zip file are,

- ITC-04 excel

- ReadMe

- Release note

GST ARA 01 - Application for Advance Ruling

Advanced ruling of GST is kind of a plan, that helps the GST payers in planning their work which is liable for GST payment in advance. This ARA is advanced ruling application that is issued by Authority of Advanced ruling under GST law.

GST ARA 01is applied when the workers or companies have to avail advanced ruling of GST payment.

8. GSTR 4 Offline Tool (Annual)

This form is filled by taxpayers usually when they have opted for composition scheme under GST. Usually a tax payer would have three returns in one financial year, but if composition scheme is opted 1 return once a year is done, through GST 4 offline tool.

System requirement for downloading GSTR 4 offline tool is,

- Operating system - Windows 7 & above

- Microsoft excel - Version 2007 & above

GSTR 4 Offline Tool ( Quarterly Filing) GSTR has to be filed on quarterly basis for every 3 months on the 18th of the last quarter. This is done when the turnover of the company is between 1.5 to 5 crore.

The downloaded file contains,

- GSTR offline utility - Excel Macro

- FAQs and User manual related to GSTR offline form

- ReadMe

- Release notes

System requirements of this offline tool are,

Operating System: Windows 7 & above. It doesn’t work on Linus and Mac.

Microsoft Excel: Version 2007 & above

Uncompress file software: WinZip or WinRAR

GSTR 6 Offline Tool with amendments

GSTR 6 tool is a GST return tool that is to be filed by Input Service Distributor(ISD) on monthly basis. This is to provide details about ITC received by an ISD. The form has to be filed even when the GST return is nil. The form contain details such as,

- Table 3 - ITC received

- Table 5,8 - Distribution of ITC

- Table 6A - ITC received (B2BA)

- Table 6B - CDN

- Table 6C - CDNC

- Table 9 - Amendment of Distribution of ITC

These details can be filled in the offline form, while there are few more details that can be filled directly during the online procedure. And the file contains,

- GSTR 6 offline form

- FAQs and User Manual related to GSTR 6.

- Release notes

9. GSTR 7 Offline Utility

This tool is used to facilitate return operations in offline mode. The GST registered individuals or businesses who wants to deduct, Tax Deducted Source (TDS) can use this utility form.

This form generally focuses of TDS liability, TDS deduction, TDS return and so on. For GSTR 7 offline mode is preferred to avoid errors while applying.

10. GSTR 8 Offline Tool

GSTR 8 is a monthly return procedure that is filed by e-commerce operators, who wants to deduct TDS under the existing GST rules. While applying it contains all details of the transaction made with e-commerce platform.

11. GSTR 9, 9A & 9C Offline Tool

All three types of offline tools are related to GST return in one particular financial year. GSTR 9 offline tool - When the registered individuals prepare for an annual GST return, i.e., it is filed once a year. This is filed by regular taxpayer filling GSTR 1, GSTR 2, GSTR 3 and GSTR 3B.

GSTR 9A offline tool - This tool comes under the composition scheme, where the tax payers file it once in every three months.

GSTR 9C offline tool - GSTR 9C is an annual audit form for taxpayers with an annual turnover of about 2 crore. This form is filed along with a reconciliation statement and certificate of an audit.

12. GSTR 10 Offline Tool

GSTR 10 tool is also known as the final return form that is filed by businesses or individuals, in case of surrender or cancellation of the existing GST registration. Within 3 months of cancellation, this has to be filed online.

13. GSTR 11 Offline Tool

When the tax payers have an Unique Identity Number to get tax credits, refunds and much more, then GSTR 11 tool is filed. This UIN is used in places when the goods and services bought in India are under GST exempt. This GSTR 11 contains details such as the,

- UIN - Unique Identity Number

- Name of the person having UIN

- Details of Inward supplies received

- Refund amount

14. Matching Tool

Matching tool is the view tool that is used to access and view GSTR 2B form. This also helps to match the auto drafted details of the GSTR 2B form with the purchase details of the business. The tool contains,

- GSTR2B_Matching_Tool_v2.0.exe (Application)

- Purchase Register Excel Template

- Readme

- User Manual

- Change History

This tool has got various system requirements in addition compared to other tools,

Operating system: Windows 7 or above. Linux or Mac doesn’t support this file.

Browser: Google Chrome 49+ or Firefox 45+

Microsoft Excel: Version 2010 or above

For versions below than the above mentioned types, the form will open in a default browser. Make sure, that your device has about 200 MB free size before downloading.

Conclusion:

You may wonder, what is the purpose of so many offline tools for GST registration or return? These steps and procedures can also be done online, but the reason of opting for offline mode is to reduce manual errors.

For all offline tools, the file gets downloaded as zip file with all the contents. The form is filed and converted to .JSON format, to be uploaded in the website which is online.

Frequently Asked Questions

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption.