Know about income tax for pensioners in India

We all know that income tax is a mandatory tax that is levied in our country. It’s the duty of every salaried person to pay a certain percentage of their income to the government in the form of income tax.

All taxpayers are required to file an income tax return each year. But does the same apply to pensioners who receive a certain amount as a pension?

Are pensions taxable? Many retired employees and senior citizens ask themselves this question. Let’s look into the details of income tax on pensions through this article.

Pension

In private companies and government organizations, workers get paid on a monthly basis as part of their retirement plan. An individual's pension is the salary credited to them at the end of his or her tenure with the company.

Every retired employee is credited with a fixed amount either monthly or annually. When employees reach 55 years of age, they can choose to receive pension income. Pensions are subject to a different tax than your regular income. There are a few benefits and details that pensioners need to be aware of.

Pensions are received by both government and non-government employees. Pensions received by both are equally taxable.

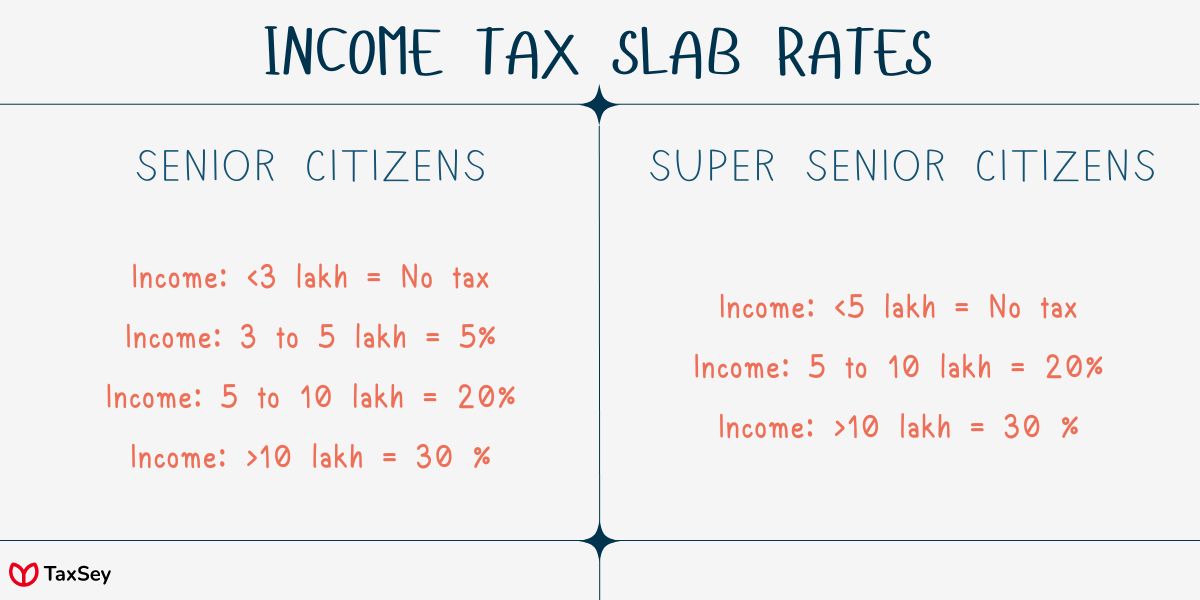

Income tax slab for senior citizens

For individuals above 60 years, income tax is calculated based on the basic salary earned, rent allowance and other allowances related to their activities. Unlike the usual income tax slab rates, seniors are entitled to a few exemptions.

Senior citizens: Individuals aged 60 to 80 years old.

• When the pension earned is below Rs. 3 lakh, no tax is levied

• Pension earned is from Rs. 3 lakh to Rs. 5 lakh, 5% tax is levied.

• Pension earned is from Rs. 5 lakh to Rs. 10 lakh, then 20% tax is levied.

• When the pension earned exceeds Rs. 10 lakh, then 30% tax is levied.

Super senior citizens: Individual above 80 years.

• Pension earned is below Rs. 5 lakh, then no tax is levied

• When it is from Rs. 5 lakh to Rs. 10 lakh, then 20% is levied

• Pension earned exceeds Rs. 10 lakh, then 30% tax is levied.

Types of Pension

Before understanding the taxation imposed on pension plans, let us examine the types of pensions. Tax is imposed on the pension received by the employees based on whether it is commuted or not.

What is the difference between commuted and uncommuted pension?

i. Commuted pension:

As long as the pension amount is received in a lump sum, either in whole or in parts, then it is called a commuted pension. The total pension is given to the person upon retirement, or it is given as a portion of the full pension.

This is optional, and is based on what the employee chooses. He can either claim his entire pension amount, or claim a small portion of it in advance.

To give an example, Mr. Arun’s total pension is Rs. 25 lakhs. If he wants, he can receive the entire amount in advance or a portion of it. All the rest will be credited to him as a monthly salary. This lump sum that is offered at the beginning is called a commuted payment.

ii. Uncommuted pension:

When the pension amount is paid to the employee periodically in the form of salary, it is an uncommuted pension. It is paid either monthly, quarterly or yearly on a regular basis. When an employee chooses an uncommuted pension, no advance amounts are given. This is nothing but salary being credited to your bank account after retirement.

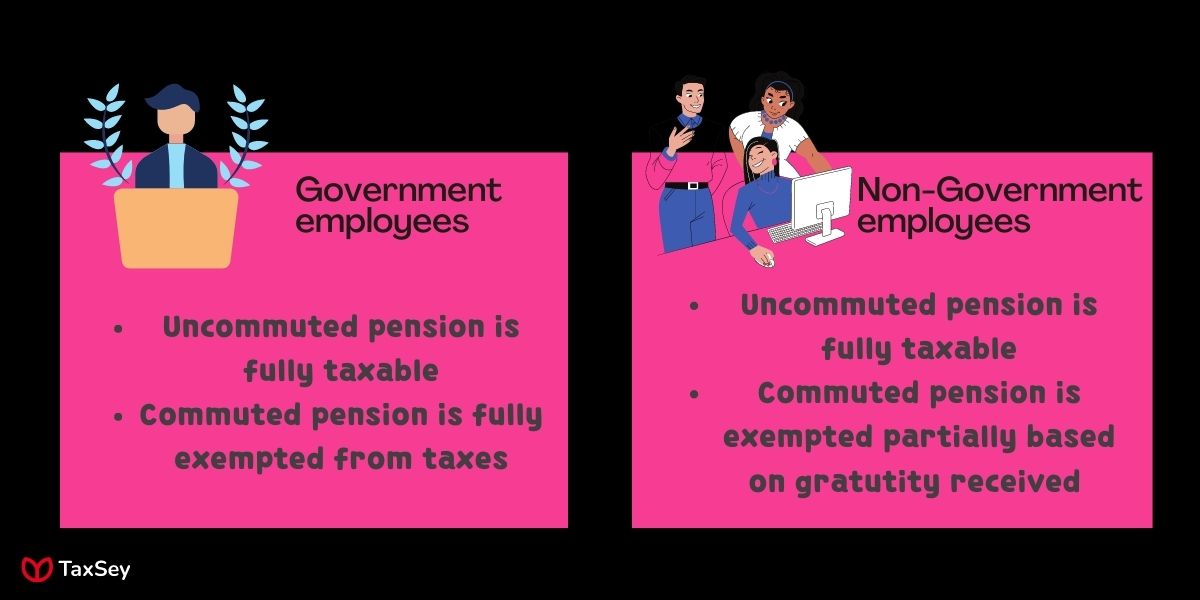

Which pension is taxable?

Now comes the next big question, which of these two pensions is taxable under the income tax act of India?

• Government and non-government employees whose pension is uncommuted are fully taxable without any exemption.

• Usually commuted pension comes under the exemption list for income tax purposes.

• Commuted pensions can be obtained both fully or partially. Based on whether you are a government or non-government employee the exemption varies.

◦ For a government employee, a commuted pension is fully exempt.

◦ Employees of non-governmental organizations are partially exempt based on the amount of gratitude they receive.

◦ When pension and gratutity is received, then 1/3rd of the pension amount is exempted from taxes.

◦ But when only a pension is received by the worker, only 1/2 of the pension is exempt from taxes.

For a government employee, both a commuted and uncommuted pension is a benefit, as it is fully exempt from income taxes. This isn’t the case for others, and selecting the right pension type plays a vital role.

Pension received by family member:

At certain times, any family member of the employee will be the one obtaining the pension. Here, the pension will be credited to the head of the family and the tax will also be levied on them. Family pension is taxed under income from other sources, because the individual earning the pension may or may not have another source of income of their own.

• Pension recevied by the family member is commuted, then it is not taxable. This includes both fully and partial commuted pension.

• In case of uncommuted pension it is taxable for a certain extend. i.e., either 33.33% from the taxable amount or Rs. 15000 is exempted. Whichever offers less, that amount is exempt from the tax.

How to file ITR for pensioners?

According to income tax department of India, ITR form 1 is used to file income tax return for senior and super senior citizens.

1) Enter Income tax return e-filing portal.

2) Login yourself, by entering the user ID and password.

3) Select the current assessment year, then click continue to proceed with the filling.

4) If you know the ITR form that has to be filled, choose the form and proceed further.

5) A list of documents that needs to be uploaded will appear on the screen, note it down and proceed for the following steps.

6) Fill details such as personal information, income details, deduction details, and additional information.

7) Click preview option and check wheter the details are entered correctly.

8) Click Pay now option and make the necessary payment from your preferred bank.

9) Return back to filing, and submit the page.

10) Proceed to validation and complete the verification process. Filing of ITR is done, once verification is over.

Conclusion

Senior citizens have a lot of tax benefits in India. But the eligibility for these exemptions are that, the individual should be more that 75 years, they should have a bank account of their own and pension should be their source of income.

If these criteria are matched, then the individuals are good to have tax exemptions from income tax.

Apart from these, PPT(Public Provident Fund), accolades such as MahaVir Chakra, Param Vir Chakra, widows, judges of supreme court are also eligible for tax exemptions under pension.

Frequently Asked Questions

In private companies and government organizations, workers get paid on a monthly basis as part of their retirement plan. An individual's pension is the salary credited to them at the end of his or her tenure with the company.