GUIDE TO LINK AADHAR CARD AND PAN CARD

Aadhar cards and PAN cards play an important role in our day-to-day lives. In order to process basic transactions and verify major proofs, these two cards are mandatory.

Acquiring an Aadhar card and PAN card is the basic requirement of every individual in India. In India, Aadhar cards are used as identification proof and to prove the identity of every individual.

Likewise PAN card is a number that is allocated by the Income tax department of India. This is where all financial transactions of an individual are recorded which makes it easier for the government to keep track of all tax related information.

Recently the government of India made it mandatory to link the aadhar card and PAN card together. How and why this is done will be covered in this article.

Link Aadhar card and PAN card

Aadhar cards and PAN cards are very important because they serve as basic proofs of identification for all Indian citizens. These documents are used by the income tax department to track each individual's activities.

Linking aadhar card and PAN card was initiated to make it easier for the income tax department to track our activities. Not only that, by doing so you can prevent your PAN card from being inactive.

The government of India made it mandatory for all citizens of India to link their aadhar card and PAN card. March 31st 2023 is set to be the last day to link the two documents. To make bank transactions above Rs. 50,000 then linking the documents is mandatory.

Different Ways to link Aadhar card and PAN card

The process of linking documents is highly crucial, as there are different methods available for completing the process.

There are four ways to link aadhar card to PAN card,

- Without logging into the income tax website

- By logging into the income tax website

- Send an SMS

- Manually by filling in a form

Let’s look at the steps of how each process is done.

Linking without logging into your account on the Income tax website

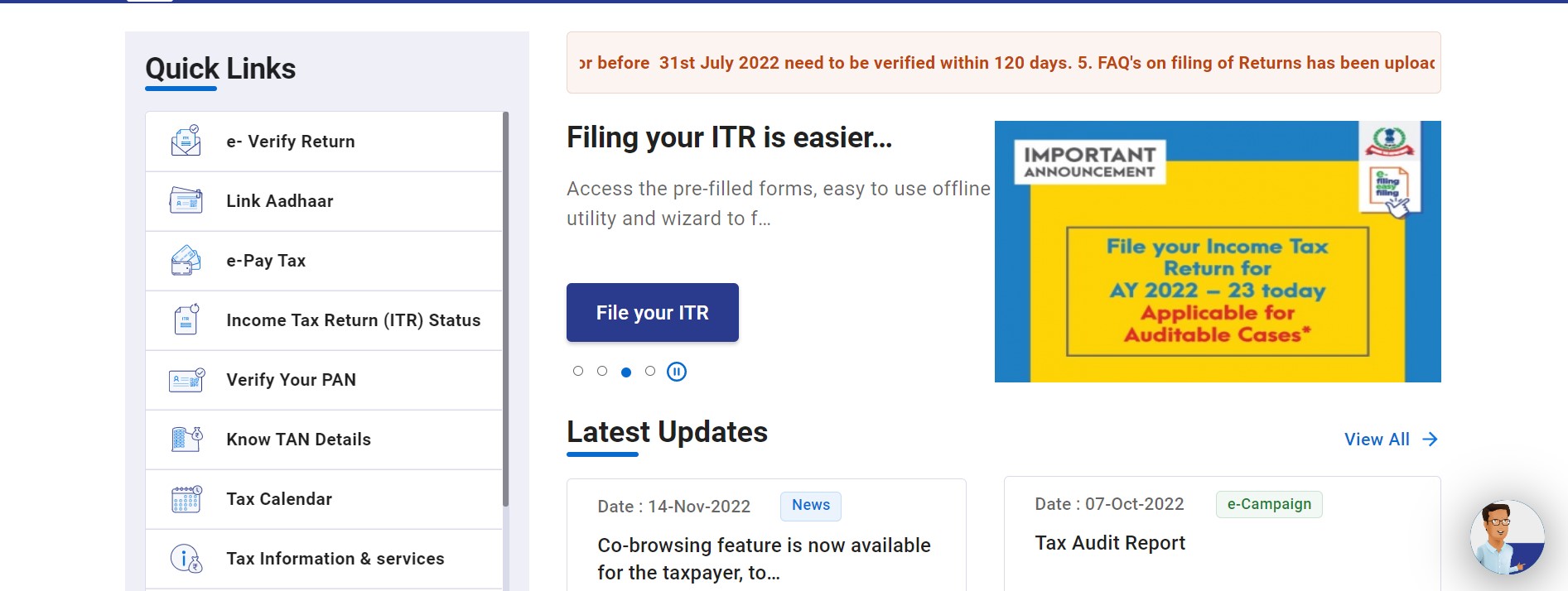

Step 1: Visit the official website of the Income tax department of India - https://www.incometax.gov.in/iec/foportal/

Step 2: Under Quick links section, click on Link aadhar option.

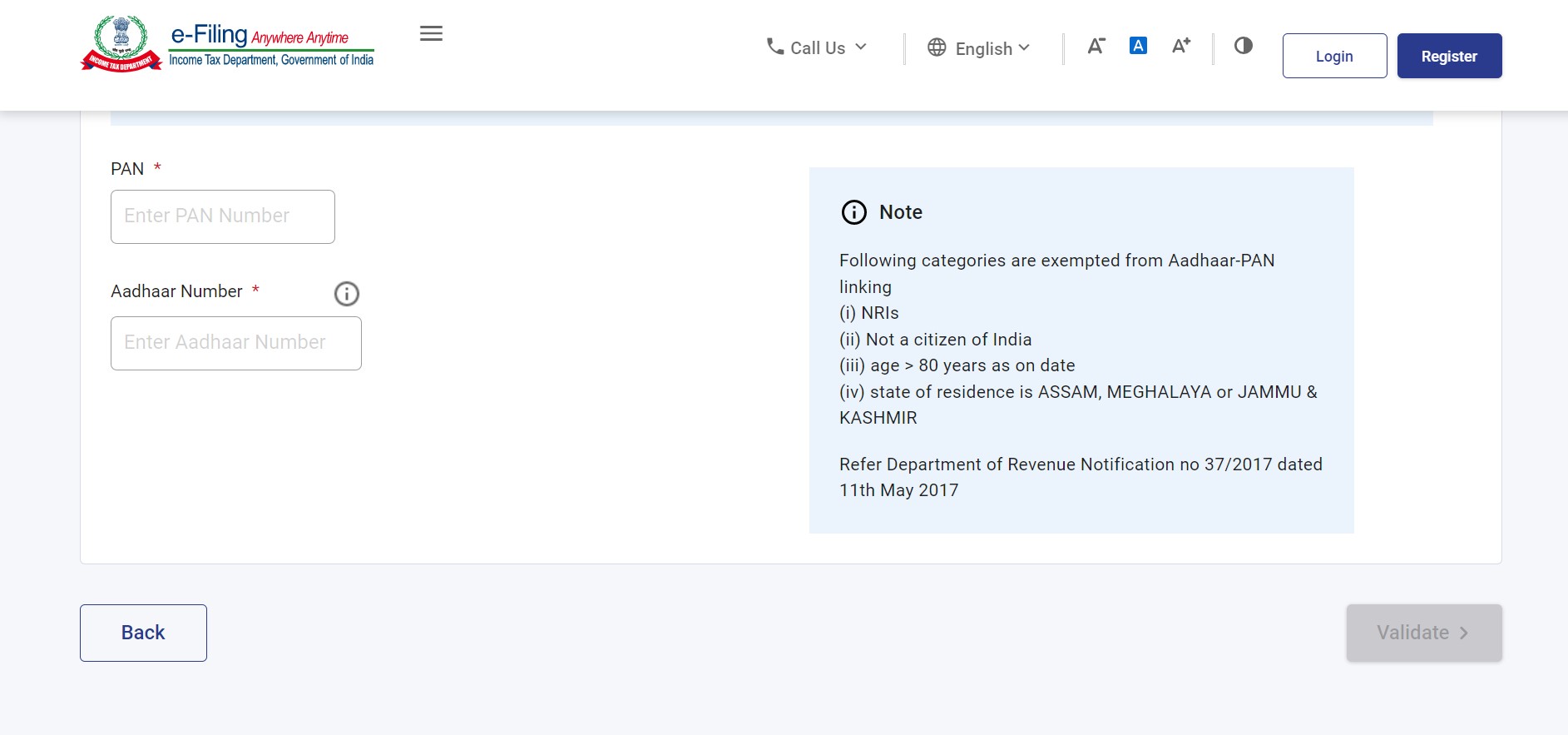

Step 3: Link aadhar tab will open. First step under this is to enter the Aadhar card and PAN card number. Once entered click on Validate.

Step 4: The next step is verification. A six-digit verification code will be sent to your mobile number. Enter the number and submit.

Step 5: Once you submit, the aadhar card will be linked to your PAN card.

Step 6: To check the status of your linking, you can later visit the official website.

Link via logging into your account in income tax website

Step 1: Visit the official website of the Income tax department of India - https://www.incometax.gov.in/iec/foportal/

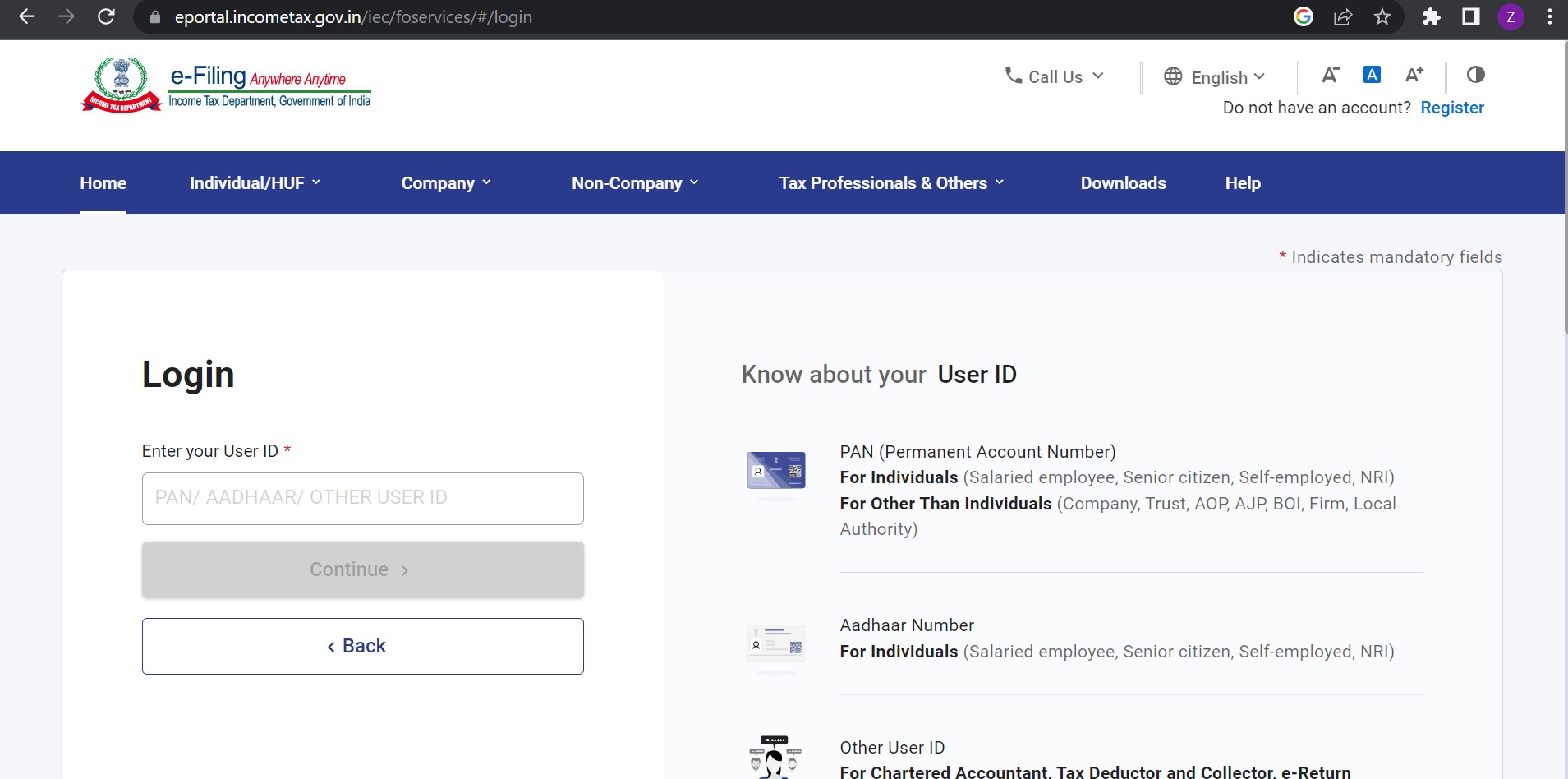

Step 2: Click on Login in the top right corner of the tool bar.

Step 3: Enter your credentials, which is your PAN number/Aadhar number/ any other user ID. Click on Continue.

Step 4: After logging into your account, various options appear on the screen. Click on Link, next to the option to link Aadhar to PAN.

Step 5: Enter the details in the fields provided and click on Link.

Step 6: A validation pop up will appear on the screen and the status can be checked later.

Linking via SMS

Online services may not be available for all residents of India. By sending an SMS, the income tax department has made the linking process convenient for all citizens.

The SMS needs to be sent through your registered phone number, and not other numbers. It can be sent to either 567678 or 56161. On sending a SMS, the income tax department will accept your request and link your aadhar card and PAN card.

The format of sending the SMS is as follows:

UIDPAN

For example, the SMS should contain

UIDPAN 123456789012 YZYZY0000Y

Linking through a manual process:

In certain cases, the details that are provided whilst linking aadhar card and PAN card may be entered wrong. People may also find difficulties while linking the documents online or through phone.

In person, linking of aadhar card and PAN card can be done in various PAN, NSDL or UTIITSL centres. Annexure 1 form is required to complete the process along with copies of Aadhar card and PAN card.

A correction fee must be paid to complete the manual process, and the fee amount varies depending on whether the correction is on a PAN or an Aadhar. But online and SMS services are free of cost.

For PAN correction the fee is Rs. 110 and for Aadhar it is Rs. 25. Biometric updates are needed for both PAN and Aadhar if the details have many mismatches.

Check the link status of PAN and Aadhar card:

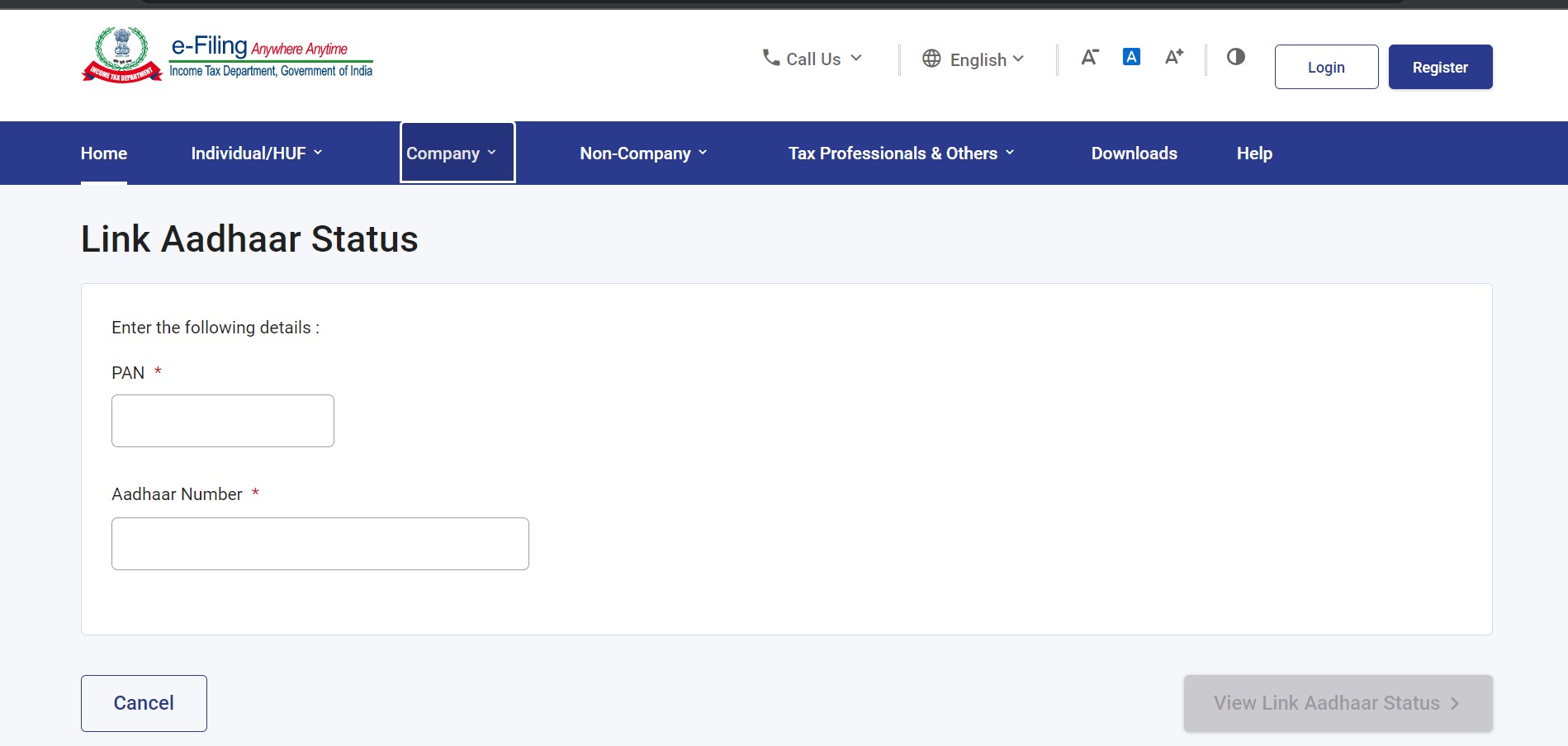

Follow the steps given below to track the status of your PAN and aadhar card link.

1. Visit the official website of Income tax department of India.

2. Quick links, choose the option Link Aadhar status.

3. Enter your PAN and Aadhar number

4. Click on View Link Aadhar status to know the details.

5. A pop-up will appear on the screen, which contains the status of your link process.

Why Aadhar and PAN should be linked?

As mentioned earlier, these two documents are the basis of identification and finacial transactions. There are various benefits in doing this process,

• All tax related transactions can be easily tracked by the government. This helps in the elimination of tax evation.

• This can reduce, the action of multiple PAN cards. Linking the documents ensures that there is only one PAN card for every individual identity.

• Government can easily track the identity and address of the person who is associated with the PAN card.

• The process saves your PAN card from inactivation by the government.

Conclusion

Now you might think, what could possibly happen if you don’t link your Aadhar card to PAN card? The consequences are severe and it may lead to the cancellation of PAN card for the individual.

For financial safety and identity verification, it is recommended to link Aadhar card and PAN card at the earliest. As citizens of India, the government can keep a track on the taxable transaction of the documents are linked.

Frequently Asked Questions

Aadhar cards and PAN cards are very important because they serve as basic proofs of identification for all Indian citizens. These documents are used by the income tax department to track each individual's activities.