Professional Tax: Check What’s the Slab Rate in Your State

Tax is a very common term for every salaried person. Previously, the Government imposed various taxes on people under varying terms, and GST was introduced to end this practice.

Likewise, Income Tax is also a mandatory tax that is paid by citizens to the government. Taxes provide the government with income. Other taxes are collected for various reasons as well.

Similarly, all taxpayers pay some amount as professional tax, or can find a deduction from their salary in terms of professional tax. Why is it so, and what does that mean is explained through this article on professional tax.

TABLE OF CONTENTS:

1. What is professional tax?

2. Applicability of professional tax

3. Exemption from professional tax

4. Who collects P tax?

5. P tax slab rates in various states

a) Slab rates in Tamil Nadu

b) Slab rates in Karnataka

c) Slab rates in Andhra Pradesh

d) Slab rates in Kerala

6. Payment mode of P tax

7. Why does P tax vary state to state?

8. Conclusion

What is professional tax?

Taxes that are levied by the government fall into two categories: direct tax and indirect tax. Professional tax or P tax is a type of direct tax that is directly deducted from the gross salary of a salaried person.

This tax is applicable to all professions, working employees and self-employment. Whenever an individual's income exceeds the assigned threshold, the tax is automatically imposed.

One can find the amount of professional tax deducted on their payslip. However, it is limited to INR 2500 per annum that can be levied as professional tax by any state government.

Professional tax is a state tax, and the state government determines the slab rates of this tax. It varies from state to state and it is not levied in all states of India. Haryana, Rajasthan, Delhi are a few states that don’t levy professional taxes.

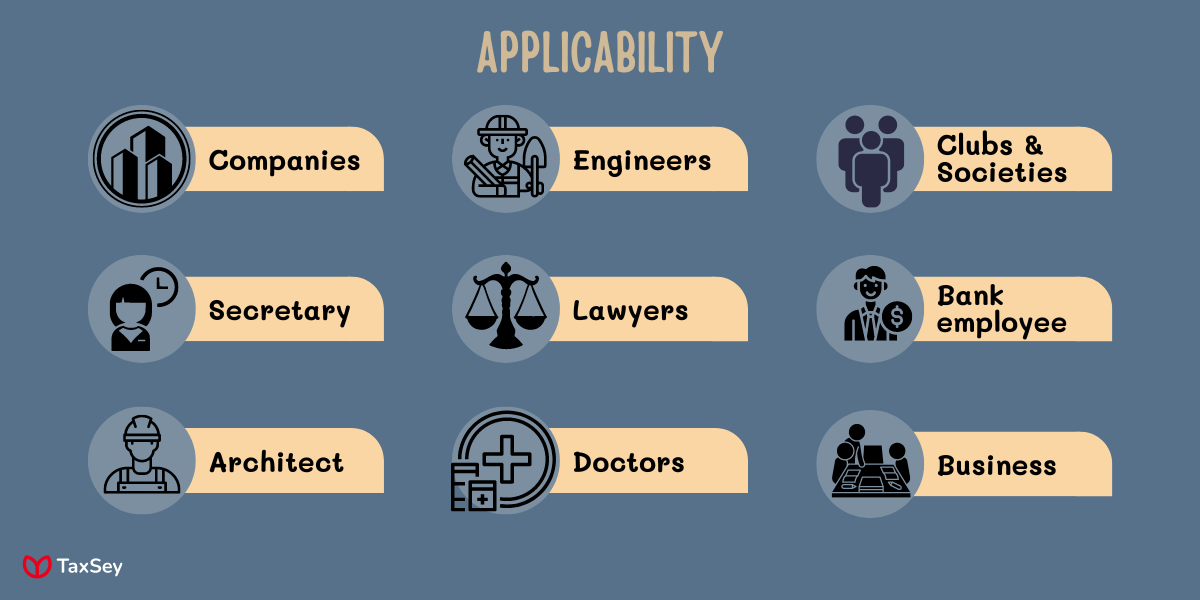

Applicability of professional tax

Taxes on professional activities are levied on all working citizens, regardless of their background, occupation or profession. List of domains who need to pay professional tax are:

Companies and organizations Business firms and corporations Limited liability partnerships (LLP) Cooperative societies and clubs Company secretary HUF Self-employed individuals Chartered accountants and freelancers Lawyers and legal practitioners Architects and engineers. Bank employees and insurance agents Tax or management consultants Doctors and medical professionals

Exemption from professional tax

The government also offers exemptions for certain categories of people from paying this tax.

Member of the Central Armed Military Forces Person with a mental or physical disability. Disability level should be more than 40% Parent of a child with any disability Individual who runs an educational institute that provides education up to twelfth standard Individuals from foreign countries who have been employed by state companies. A person who runs charitable hospitals below taluk level Senior citizens above the age of 65 Temporary workers employed in textile companies. Female agents of the government scheme, Mahila Pradhan Kshetriya Bachat Yojana.

Who collects P tax?

The state government collects a property tax from the people. Every state's commercial tax department collects the P tax from the people on behalf of the municipal corporation, however.

Whenever a person owns a company, he must collect P tax from all his employees. Taxes are paid collectively by the owner to the appropriate department, and depending on the business nature, they may be paid monthly or annually.

The P tax must be paid by employees to their respective employers. In addition to the P tax, employers pay the commercial tax department a portion of their gross income. Sole proprietors, free lancers have to register themselves and obtain a professional tax certificate, to pay their professional tax to the department.

P tax slab rates in various states

Slab rates in Tamil Nadu

INCOME (HALF - YEARLY) SLAB RATE Rs. 21,100 to Rs. 30,000 Rs. 100 Rs. 30,001 to Rs. 45,000 Rs. 235 Rs 45,001 to Rs. 60,000 Rs. 510 Rs. 60,001 to Rs. 75,000 Rs. 760 Above 75,000 Rs. 1,095

INCOME PER MONTH SLAB RATE Up to Rs. 3,500 NA Rs. 3,501 to Rs. 5,000 Rs. 22.5 Rs. 5,001 to Rs. 7,500 Rs. 52.5 Rs. 7,501 to Rs. 10,000 Rs. 115 Rs. 10,001 to Rs. 12,500 Rs. 171 Above 12,500 Rs. 208

Slab rates in Karnataka

INCOME PER MONTH SLAB RATE Up to Rs. 14,999 NA Above 15,000 Rs. 200

Slab rates in Andhra Pradesh

INCOME PER MONTH SLAB RATE Up to Rs. 15,000 NA Rs. 15,001 to Rs. 20,000 Rs. 150 Above Rs. 20,000 Rs. 200

Slab rates in Kerala

INCOME (HALF - YEARLY) SLAB RATE Rs. 12,000 to Rs. 17,999 Rs. 120 Rs. 18,000 to Rs. 29,999 Rs. 180 Rs. 30,000 to Rs. 44,999 Rs. 300 Rs. 45,000 to Rs. 59,999 Rs. 450 Rs. 60,000 to Rs. 74,999 Rs. 600 Rs. 75,000 to Rs. 99,999 Rs. 750 Rs. 1 lakh to Rs. 1.25 lakh Rs. 1,000 Above Rs. 1.25 lakh Rs. 1,250

Payment method for P tax

Collection of P tax varies in each state, so there isn’t a single method that can be used to pay the tax. So each state has defined a specific payment option to pay your professional taxes.

Tamil Nadu

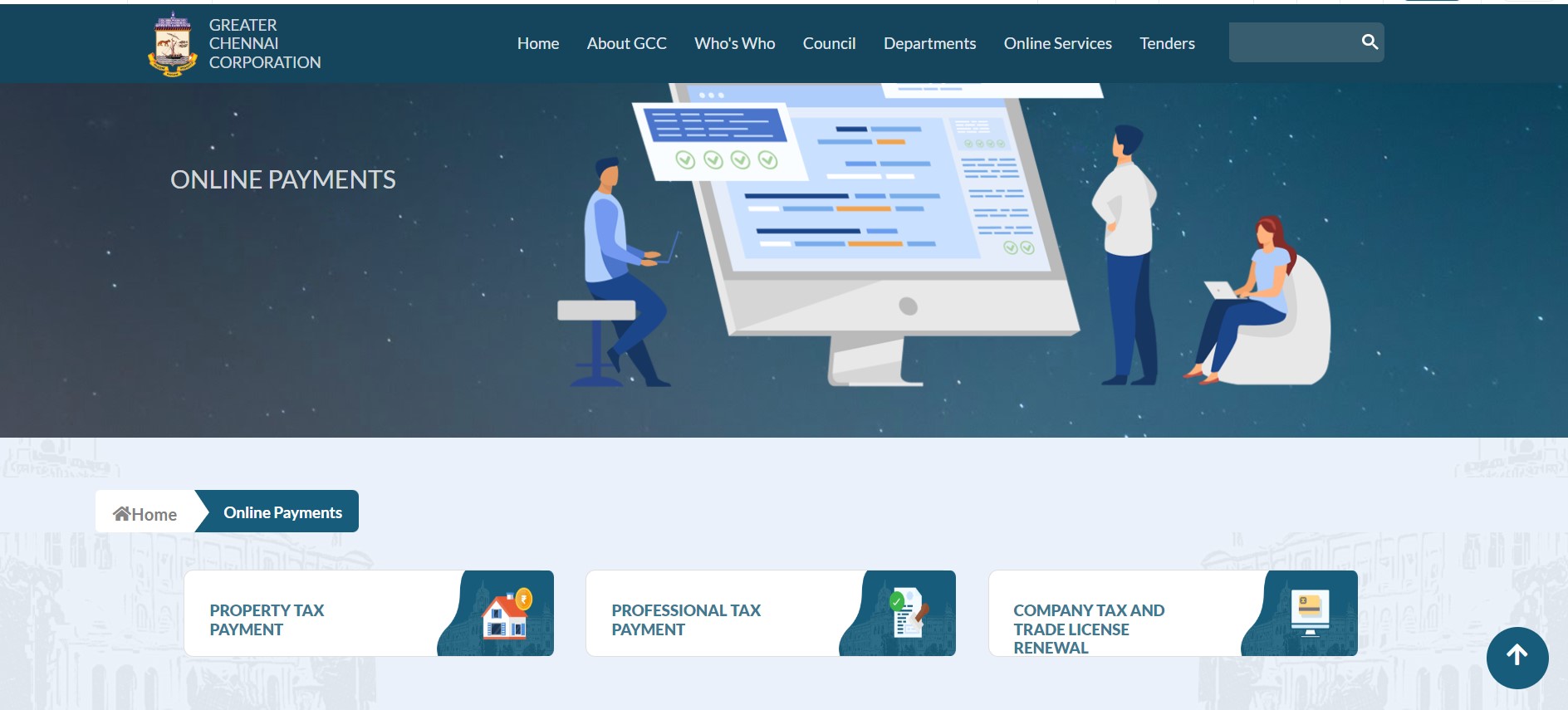

In Tamil Nadu, the payment of tax is done via Greater Chennai Corporation’s official website. The steps for payment are as follows:

- Visit the Greater Chennai Corporation official website.

- Select the ‘Online Payments’ option.

- You will find the ‘Professional Tax Payment’ option.

- A new tab will open. Search for your acknowledgement number and fill in the required details.

- Choose the payment option - debit card, credit card or net banking. Once the process is complete, payment is made.

Andhra Pradesh

Andhra Pradesh follows an entirely different method of payment. This government offers two forms

i. Form I: which is used to pay taxes on a monthly basis.

ii. Form II: which is used to pay taxes for every financial year. To make a payment, visit the official website of the Department of Official Taxes. Choose the option if it is Form I or Form II and proceed with the payment. Registering on the official portal is an absolutely essential step before paying P tax.

There are two kinds of registration based on the employment mode of the individual:

a. Professional Tax Registration Certificate: When the individual is working as an employee in any company.

b. Professional Tax Enrollment Certificate: When the individual is self-employed or a freelancer.

Register yourself by choosing the right option and proceed with tax payment. Not registering also involves a fine payment.

Why does P tax vary from state to state?

As mentioned before P tax is unlike other taxes that is levied in India. Since it is a state tax, the rules and guidelines are determined by the respective state governments. This tax is optional and the state government can decide whether to levy it or not. A slab rate is determined by the gross income of the individual. The tax can be levied monthly, half-yearly or annually.

Not just the slab rate that every individual pays also varies. This entirely depends on the income he/she earns and the tax is imposed based on the threshold limit of their respective salaries.

What happens when you violate P tax?

The payment of P tax is also a mandatory process, just like GST and Income Tax. So violating the rules and regulations leads to a penalty and fine, which is also determined by the state government and varies from state to state.

Not to mention that every state government also sets a time period during which payment has to be made. If payment is not received within the deadline, a fine is imposed.

In Tamil Nadu, the payment of professional tax is to be done from April 1 to October 1 during the half-year period of every year. For non-payment of tax, a 10% penalty is imposed, and for delayed payments, a 2% penalty is imposed.

Likewise in Andhra Pradesh, payment has to be made before 30th June of every financial year. The penalty for non-payment ranges from 25% to 50%.

Conclusion

Every tax that is levied is a form of income to either the central or state government. When it comes to payment of taxes, it is the duty of every citizen to pay it before the deadline mentioned by the government.

The main purpose of levying professional tax from all citizens is to utilize the collected amount towards the professional services of the state. Though P tax considered as a revenue, it is used for the betterment of the services in every state.

Now pay your taxes on time, understanding the exact purpose of it.

Frequently Asked Questions

Tax is a very common term for every salaried person. Previously, the Government imposed various taxes on people under varying terms, and GST was introduced to end this practice. Likewise, Income Tax is also a mandatory tax that is paid by citizens to the government. Taxes provide the government with income. Other taxes are collected for various reasons as well.