Section 80DDB: A Way for Tax Deduction

In various situations the Income tax department of India offers tax deductions to taxpayers. Tax payers may benefit from this deduction if they can claim it at the right time and pay a limited amount.

Taxpayers who are undergoing the treatment of certain diseases or individuals who cannot afford their medical treatment can take advantage of deductions from their taxes.

To get this deduction, all you have to do is learn about Section 80DDB. This article will guide you through how to claim and other features of Section 80DDB.

TABLE OF CONTENTS:

1. What is Section 80DDB?

2. Eligible candidates

3. Maximum deduction limit permitted

4. Diseases or ailments under Section 80DDB

5. Who can issue a certificate?

6. Details on the medical certificate

7. Steps to fill form 80DDB

8. Things to remember

What is Section 80DDB?

Taxpayers have always been offered deductions by the income tax department under special circumstances. A section 80DDB exception falls under this category.

Under Section 80DDB of the Income Tax Act of 1961, tax payers suffering from specified diseases may claim an exemption from taxes. This exemption is based on the expenses incurred to treat the disease.

This deduction can be claimed if the illness is for the taxpayer or for their related family member. Family members include spouse, children, parents or any other member who is dependent on the taxpayer.

Once the taxpayer submits appropriate documents and medical reports, the tax deduction can be claimed easily. One major criteria is that the individual should be a resident of India.

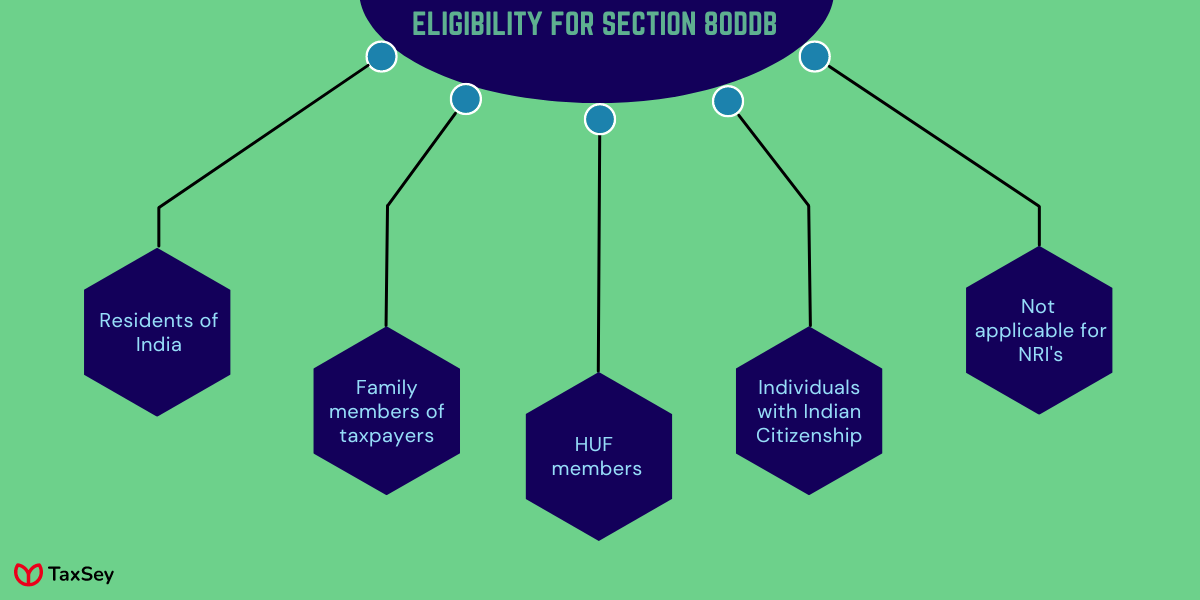

Eligible candidates

This tax exemption under Section 80DDB can be availed of by a certain group of people, listed below.

• Individuals who are residents of India either born or through citizenship.

• Family members of an individual taxpayer, such as a spouse, children, parents or dependent siblings.

• When the taxpayer is a member of HUF. If the individual is responsible for the medical expenses incurred by any member of HUF, tax deduction can be claimed.

• In the case of NRI’s, the deduction can’t be claimed. It is mandatory for the taxpayer to be a resident of India.

Maximum deduction limit permitted

We have stated in this article that people with particular diseases are able to access this section. But the deduction limit is entirely based on the age of the taxpayer who needs to claim the benefit.

The individual claiming this benefit must submit the expenses that were incurred by him or her. So the deduction will be the lesser amount from the total amount that was paid for the treatment.

In general, the deduction amount is capped at Rs. 40,000 for normal individuals and Rs. 1,00,000 for senior citizens and super senior citizens. Depending on the expenses made, the amount will increase or decrease this amount.

You should also be aware that the amount of any insurance used to claim the medical expenses of a treatment will be subtracted from the deduction limit.

In short,

• Citizens (under 60 years) may deduct Rs.40,000 or a lesser amount from their actual expenses.

• Senior citizens (Above 60 years), the deduction limit is Rs.1,00,000 or lesser amount from actual expenses.

• Super senior citizens (Above 80 years), the deduction limit is Rs.1,00,000 or lesser amount from actual expenses.

Diseases or ailments under Section 80DDB

Rule 11DD of the Income Tax Act 1961 gives us a list of diseases that qualify for a deduction under Section 80DDB. When medical records and expenses for the following diseases are submitted, tax deductions can be claimed easily.

- Neurological diseases - disability level above 40%

a) Dementia b) Dystonia Musculorum Deformans c) Motor Neuron disease d) Ataxia e) Chorea f) Hemiballismus g) Aphasia h) Parkinson's disease

- Malignant cancers

- Acquired Immuno-Deficiency Syndrome (AIDS)

- Chronic renal failure

- Hematological disorders

a) Hemophilia b) Thalassaemia

Who can issue a certificate?

Proof of the diseases listed above should be submitted in the form of a medical certificate. These certificates should be issued by specialists in that particular disease or ailment.

1. Neurological disease - a neurologist who has a Doctor of Medicine degree in neurology or any other equivalent degree.

2. Cancer - an oncologist who has a Doctor of Medicine degree in oncology or any other equivalent degree.

3. AIDS - a specialist who has a PG degree in general or internal medicine or any other equivalent degree.

4. Chronic renal failure - a nephrologist who has a Doctor of Medicine degree in nephrology or a urologist who has a M.Ch degree in Urology or any other equivalent degree.

5. Hematological disorders - a specialist who has a Doctor of Medicine degree in hematology or any other equivalent degree.

An important note to remember is that all these degrees should be recognized by the Medical Council of India. If the taxpayer takes his treatment in a government hospital, then any specialist who works full time can issue a prescription.

Details on the medical certificate

There is a recommended format that should be followed when issuing a medical certificate. This is to ensure that the right taxpayer claims the benefit of Section 80DDB. In the past, Form 10-I was filled out, which is no longer required.

The particulars must contain:

1. Name of the patient

2. Age

3. Name of the specified disease

4. Details of the doctor

a. Name

b. Address

c. Qualification - degree

d. Registration number

5. If treatment is taken in a government hospital, then the name and address of the government hospital should be mentioned.

6. Signature of the head doctor of the hospital.

Apart from this, there are a few more documents that are to be submitted to the income tax department of India. Those documents are as follows:

Self declaration certificate: This is a self declaration that has to be given by the taxpayer. The certificate should state that the medical expenses incurred by the taxpayer are true and genuine.

Insurance receipts: In certain cases, medical expenses are claimed through insurance policies. You must submit insurance receipts in relation to insurance claims, but only for life insurance policies and not for health insurance policies.

Steps to fill form 80DDB:

Form 10-I is the form related to Section 80DDB. According to the newly changed rules, it is not necessary to fill in the form. In the case of dependent members with disabilities such as autism and cerebral palsy, it is mandatory to submit Form 10-I.

- Download Form 10-I from the website of the income tax department of India.

- Mention the taxpayer’s name

- Enter the taxpayer’s father's name and address.

- Enter the name of the patient who has the medical ailment and his/her relationship with the taxpayer.

- Check rule 11D if the ailment or disease is listed and the disability level is over 40%.

- Enter the specialist doctor’s name, address, qualification degree, and registration number. In the case of a government hospital, enter the name and address of the hospital.

- Obtain the signature of the head doctor and submit it with the other documents.

This form and other certificates should be submitted while filing the income tax return for the previous year.

Things to remember

There are certain conditions that must be met in order to qualify for a tax deduction under Section 80DDB. The points are as follows:

• A hard copy of the medical certificate or prescription that serves as proof of disease should be submitted.

• The certificate should be issued by the central or state government medical board.

• Only life insurance policies are accepted for deductions.

• In the event of the death of the beneficiary, the plan should pay a lump sum amount to the patient.

• Refunds are credited to the concerned person if the person died before the taxpayer. This will be taxable income.

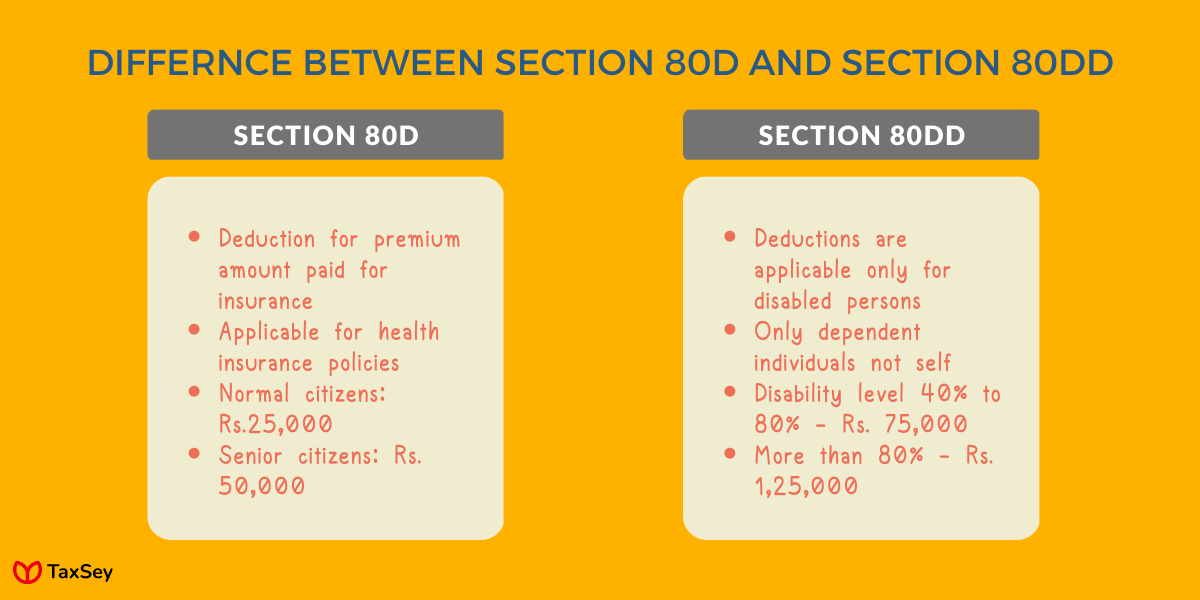

What are Section 80D and 80DD?

Similar to Section 80DDB, there are few more sections under the Income tax department of India, which offers tax deductions under medical terms. That is Section 80D and Section 80DD.

So what is section 80D?

Taxpayers can claim tax dedications for the premium amount that is paid for medical insurance policies. This can be claimed from the total income tax that is paid by the individual every year.

Unlike section 80DDB, this section is applicable for health insurance policies and also to the premium amount paid for their family members. The dedication amount that can be claimed for one financial year is Rs. 25,000 and incase of senior citizens it is Rs. 50,000.

Next is Section 80DD,

A taxpayer can claim deduction under Section 80DD, when the resident individual or HUF member who is dependent on the taxpayer is differently abled. When the disabled patient is entirely dependent on the taxpayer for support and maintenance, then he can claim Section 80DD.

But this section is applicable only for dependent individuals and not for self and the patient should be a resident of India. The amount claimed depends on the disability level,

• Disability level is more than 40% and less than 80%, then the deduction amount claimed is Rs. 75,000

• When the disability level is more than 80%, then the deduction amount is Rs. 1,25,000.

Conclusion

Income tax filing and income tax returns are mandatory actions that have to be done by every salaried employee in India. When it comes to medical aid, it could sometimes be hard to pay the total income tax amount.

The government of India, offers various benefits and claims for taxpayers to avail deductions from income tax. This section 80DDB is one such benefit, for taxpayers and their dependents to avail at crucial situations.

Taxsey - Hassle free eFiling Income Tax Return Online

TaxSey provides a solution for all your queries. One stop place for income tax, GST, investments, and much more. Just search for TaxSey to learn about all taxation systems.

TaxSey has various tools and services like individual income tax filing, GST filing, a simple interest calculator, a SIP calculator, and the list goes on. Instead of visiting multiple pages, you can complete all your actions on a single page.

TaxSey is definitely the perfect product for businesses, companies and also for normal individuals. Taxes being a part of everyone’s life, it is essential to know about TaxSey and its services to make our jobs easier.

Frequently Asked Questions

Taxpayers have always been offered deductions by the income tax department under special circumstances. A section 80DDB exception falls under this category.