EVERYTHING YOU NEED TO KNOW ABOUT TAN

We must obtain PAN cards, because it is mandatory for all taxpayers to hold a PAN card. PAN is a ten digit alphanumeric code, which is an electronic system that is used to save all tax related information about an individual.

Have you heard about TAN? TAN number is also related to income tax and tax transactions associated with the Income tax department of India. In this article we will get into all the details and importance of TAN.

What is TAN?

Just like how PAN is used as a tax identity for every citizen in India, TAN is used as a tax identification number for people related to tax collection and deduction. This is abbreviated for “Tax Deduction and Collection Account Number.”

TAN is a 10-character alphanumeric code that is associated with persons who handle Tax Deducted Source or Tax Collected Source in the Income tax department of India.

We know that PAN is mandatory for all citizens in India, but who should avail of a TAN number? Individuals who can deduct taxes at source or collect taxes at source should get a TAN number.

Who can apply for TAN?

TAN number needn’t be obtained by all tax payers. It is extremely important to mention TAN numbers on TDS/TCS returns, payment challans, and certificates.

As per Section 203A individuals who need to deduct or collect tax at source are required to obtain TAN. If they do not obtain it, they have to pay a penalty of Rs. 10,000.

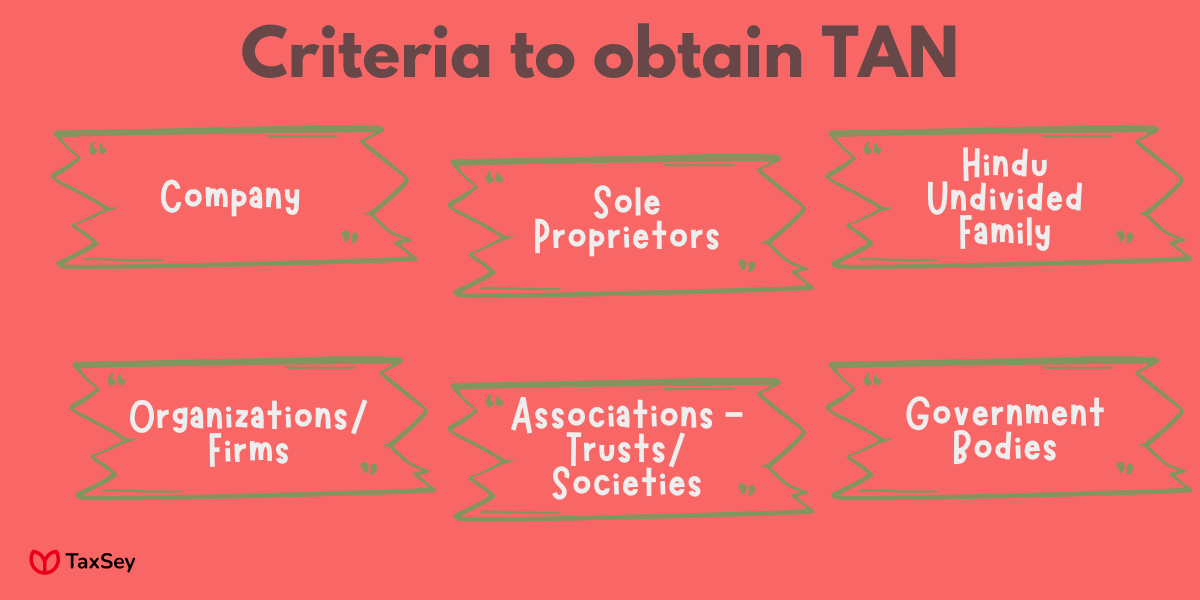

Income tax department of India has mentioned the eligibility criteria to obtain TAN which is as follows:

• Company

• Sole Proprietors

• Hindu Undivided Family

• Organizations/Firms

• Associations or persons - i.e. trusts or societies.

• Government bodies such as central government, state government, local authorities, autonomous bodies etc.

Importance of TAN

Tax related transactions have a great deal of significance for TANs. In certain cases, not holding a TAN number can lead to a penalty of Rs. 10,000 from the Income tax department of India.

• Without the TAN, one cannot file TDS/TCS statements.

• TAN number is necessary for various deductions such as salary, interest, dividends, etc.

• TAN is required to obtain challans, returns and certificates related to TDS/TCS.

• If TAN is not present, it is not possible to collect or submit forms related to IT and other forms.

• Acquiring a TAN number automatically identifies the address and post office associated associated with the individual during tax transactions.

Structure of TAN

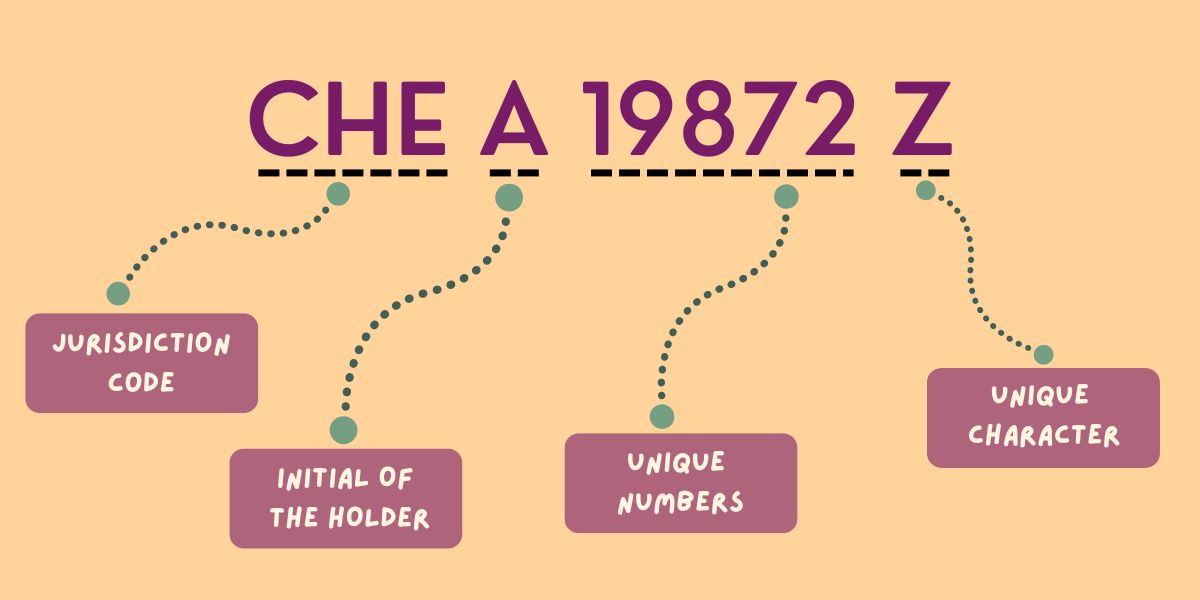

TAN consists of 10 alphanumeric characters, which have a defined structure in which each character signifies various details. This structure is laid out so that the first 4 alphabets are followed by 5 numbers, then 1 alphabet.

What does TAN stand for?

• The first three alphabets represents the jurisdiction code.

The jurisdiction code represents the location where tax transactions take place. In this case it is generally a city or state where the transactions occur.

• The fourth alphabet shows the initial of the holder.

It does not have to be an individual's name. If it is a firm or company, then that is considered an individual and its initials are taken into account.

• The next five numbers have no special meaning or significance.

This is just a unique number that is generated by the system, which is unique to each individual. • Last alphabet is a unique identity character. For example, Let us consider Mr. Alex from Chennai has requested a TAN number. It would be similar to CHEA19872Z

• CHE - represents the place where transactions take place, i.e., Chennai

• A - represents Alex who is the holder of TAN

• The remaining numbers and the last alphabet are unique identifiers generated by the system.

How to apply for TAN?

TAN can be obtained online as well as offline. Though offline methods are available, online application portals have been made easier to simplify the process of applying for TAN.

Offline application procedure:

Offline application for TAN is done by filling out Form 49B. Under section 203A of the Income tax Act, this form 49B is used for the allotment of tax deduction and collection account number.

Form 49B can be obtained from,

• The form can be downloaded from the official website of the Income tax department of India.

• The forms are readily available in TIN-FC centre, which is free of cost.

• A legible and clear photocopy or scan of the form is also accepted at NSDL centers.

Those who wish to apply for TAN in offline mode should fill this form 49 and submit it to any TIN-Facilitation center. During the submission of the form, a certain amount is collected as a processing fee. The processing fee can be submitted in the form of cash, cheque or DD. Online application procedure:

The process to obtain TAN through online mode can be done through the NSDL website. The steps for online application are as follows:

• Go to the NSDL official website - https://tin.tin.nsdl.com/tan/form49B.html

• Fill the form 49B in online and submit the details that need to be entered.

• On submitting the form, make a payment of Rs. 65 as processing fee through credit card/debit card/net banking.

• Upon successful payment, an acknowledgement slip will appear on the screen. Download it for further enquiries.

• The acknowledgement slip contains information such as,

• A 14 digit unique acknowledgement

• Contact and payment details

• Name and status of the applicant

• Space for the applicant's signature.

Make sure that you take a copy of the acknowledgement slip in printed form. Because it is necessary to track and know the details of your TAN status.

There isn’t any requirement for document submission or identity proof to obtain your TAN. In online mode, the signed acknowledgement slip should be sent to the NSDL address.

Know your TAN - Income Tax Department

While we all have PAN cards, when you apply for TAN you will not receive any card or letter at your home. To obtain your TAN number, there are a few steps

i. Visit the income tax e-filing portal website - https://t.me/picxelesponsorship

ii. On the left hand side, under quick links choose the option “know TAN details”.

iii. Under TAN search choose either Name/TAN.

iv. Select the category of deductor from the drop down menu.

v. Select the state where you belong.

vi. When applying, enter the mobile number associated with the TAN.

vii. Click “continue”. An OTP will be sent to your mobile number.

viii. Enter the OTP and click on “validate”. TAN details will appear on the screen.

For any error or correction to be made, all you need to do is fill out the change request form on the NSDL website. The same process can be used to surrender or cancel the TAN.

• A copy or proof of the currently available TAN.

• A TAN that needs to be cancelled or surrendered.

• TAN allotment letter or details of TAN

After submission of these documents, any changes or cancellations can be made online.

Conclusion

Like PAN cards, TAN cards also hold a lot of importance among citizens and tax payers in India. Any deduction or collection of tax cannot occur without the submission of TAN.

It is mandatory for individuals who avail TDS/TCS return to obtain a TAN number. Penalties will be imposed on those who fail to comply.

Frequently Asked Questions

Just like how PAN is used as a tax identity for every citizen in India, TAN is used as a tax identification number for people related to tax collection and deduction. This is abbreviated for “Tax Deduction and Collection Account Number.”