Types of GST in India:

Paying taxes is an integral part of every individual's life. From small lists to big bills, there is a separate category where taxes are levied on every purchase that we make. Shouldn’t we know what each tax division means? The taxation method used to cause a lot of confusion previously. There were a lot of problems with VAT, which caused the tax system to be chaotic. This is where GST was introduced by the Government of India.

In this article, we will discuss the different types of GSTs that are categorized and their specifications.

1. GST: Introduction

The term is very familiar now, and it abbreviates to Goods and Services Tax. GST came into force from 1st July 2017, to put an end to the previous method of taxation called VAT.

Apart from that, GST was introduced as a way to bring a "One nation, One tax" system, so unwanted state taxes could be minimized. Every product was given a separate slab rate, and tax amounts were collected accordingly.

2. GST: Types

After we say that, GST is levied on every product that we buy. Nevertheless, the bill mentions a number of different divisions. So what are those?

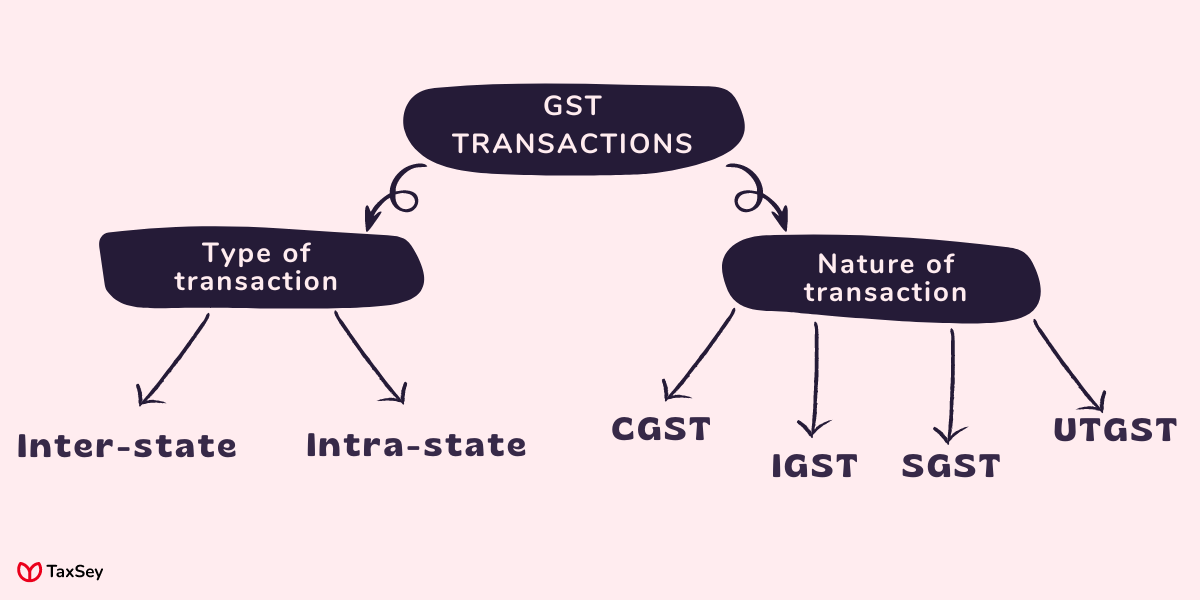

GST is classified into two types based on the type of transaction made.

i. Inter-state transactions

ii. Intra-state transactions

And based on the nature of the transactions, the types of GST are

i. SGST

ii. CGST

iii. UTGST

iv. IGST

Let us look at the detailed explanation of every type.

3. Inter-state transactions

Taxes levied on interstate transactions are assessed when goods and services are supplied from one state to another. In particular, the location of the supplier and customer should be in different states.

A transaction can be between two different states, two different union territories, or between a state and a union territory. The GST collected by the central government and the state governments is divided equally.

In addition to these, when goods are imported into India, they are considered interstate until they reach the custom officer for further processing. IGST falls under inter-state transactions.

Intra-state transactions:

In contrast to interstate transactions, intrastate transactions refer to goods and services exchanged within the same state or union territory. Regardless of being within the same state, if the goods or services are in a special economy zone, they will be interstate transactions.

Here CGST, SGST and UTGST falls under the intra-state category.

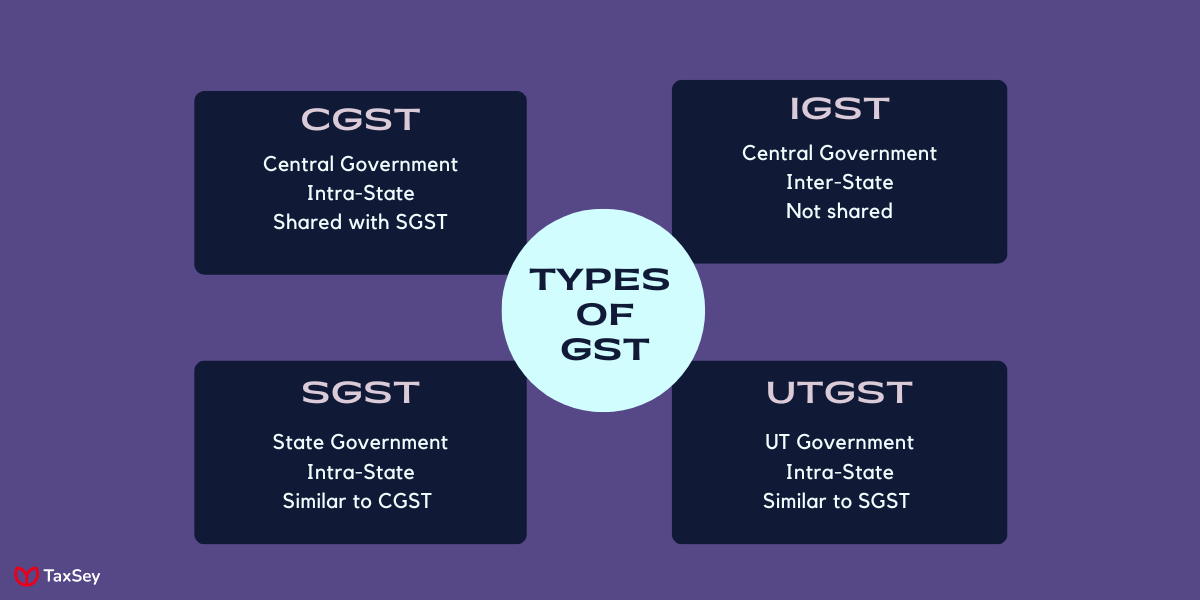

4. CGST

CGST is abbreviated as Central Goods and Services Tax, which is the tax that is collected by the central government from overall GST. Whatever tax rate, is levied as CGST is directed towards the central government.

This is not collected as a separate slab rate, instead it is collected alongside SGST and IGST.

For example, let’s assume a purchase of about Rs. 15000 has been made. The GST charged is 18% in which 9% is CGST and 9% is SGST. So the total payment is Rs. 17,700, in which Rs. 1350 will be under CGST.

The implementation of CGST, ended the previous taxes like,

- Central excise duty

- Service taxes

- Custom charges etc.

5. SGST

State Goods and Services Tax (SGST), is the taxing authority that is under the state government. This is also shared with the CGST, as mentioned earlier.

Taking the previously mentioned example, when 18% GST is charged on goods worth Rs. 15,000, of which 9% is directed towards state government. i.e., Rs. 1350 is for the State government.

This SGST is applicable for all state governments, including two union territories - Delhi and Pondicherry because they have an independent council. SGST ended the previous system taxes like,

- Purchase tax

- Luxury tax

- Entertainment tax etc.

6. UTGST

UTGST or Union Territory Goods and Services Tax is exactly similar to SGST, but the difference is that, it is applicable only to the five union territories of India. This includes,

- Daman and Diu

- Chandigarh

- Lakshadweep

- Dadra and Nagar Haveli

- Andaman and Nicobar Islands

The major difference between CGST and UTGST is that, UTGST entirely comes under the supervision of Central government as the union territories don't have an independent elected assembly.

7. IGST:

Integrated Goods and Services Tax is levied when the supply is between different states or union territories. This is a type of inter-state transaction under GST.

Not just the transactions made with two different states, this also includes all the supplies made outside the country. When IGST is charged, it is not divided, instead the whole amount is directed towards the central government.

For example, when Rs. 15,000 is involved in the transaction for which 18% tax is levied in the form of IGST. The total amount payable is Rs. 17,700, in which entire Rs. 2700 is sent to the central government treasury.

Conclusion:

The four types of GST that are imposed on goods and services are CGST, SGST, UTGST and IGST. Though there are various types, they are all referred to as GST. The reason for the types is to divide the revenue between state and central governments.

This method of taxation has lead to a more smooth taxation process unlike the previous VAT system, where taxes were levied on tax. With a more convenient method, this has also lead to reduction in price of goods.

Frequently Asked Questions

Among the benefits of GST was the end of the previously unorganized tax system known as VAT. It subsumes unwanted taxes like custom duties, purchase taxes, luxury taxes and so on.

In summary, GST is a more convenient and easy way to pay taxes, and it reduces the price of goods. The problem with taxes being levied on tax was ended with the help of GST.

When the supply of goods and services are within a state or UT it is called intra-state. A similar transaction between two different states or the state of Utah is considered interstate. When it is intra-state, the tax collected is shared as SGST and CGST. But when it is inter-state, the entire amount belongs to the central government.

The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption.