EVERYTHING YOU NEED TO KNOW ABOUT UNIVERSAL ACCOUNT NUMBER

Investments are the next step that is usually carried out by salaried individuals. You could think of various ways to invest, but one of them is offered at your workplace, and that is the pension fund.

Every employee who has worked for the company for more than 20 years is given a provisional fund as a savings mechanism. It is the responsibility of the company to take care of this retirement plan for all its working employees.

Assets related to money are identified by an account number. Universal Account Number is a unique number that is given to every provident fund holder. Let’s look at its uses and advantages in this article.

What is a UAN?

UAN is Universal Account Number which is a 12 digit number that is generated by the Employee Provident Fund Organization (EPFO). This number is given to all PF account holders, which holds the details of their savings.

This account number is authenticated by the Ministry of Labour and Employment under the government of India. By offering online services, this account number aims to facilitate transactions with the PF account.

If you change jobs or places of work over the course of your employment years, your UAN remains constant. Each time an individual switches jobs a new identification number is generated, using which you can link to your existing UAN number. This makes it easier to manage the PF account.

What is the need for UAN?

• The purpose of every account number is to provide easy management of assets and transactions involved in the account. Similar use is identified in the generation of UAN.

• The government can track the history of jobs that have been changed by an individual.

• The EPFO has access to information about the employee's bank and Know Your Customer (KYC) details.

• Systematic management of PF accounts was achieved after the introduction of UAN.

• Even if an employee changes jobs, the UAN remains constant and different ID’s are given to the individual.

• The procedures followed for the verification of employees eligible for PF scheme were simplified and the data collected is maintained properly under the Government of India.

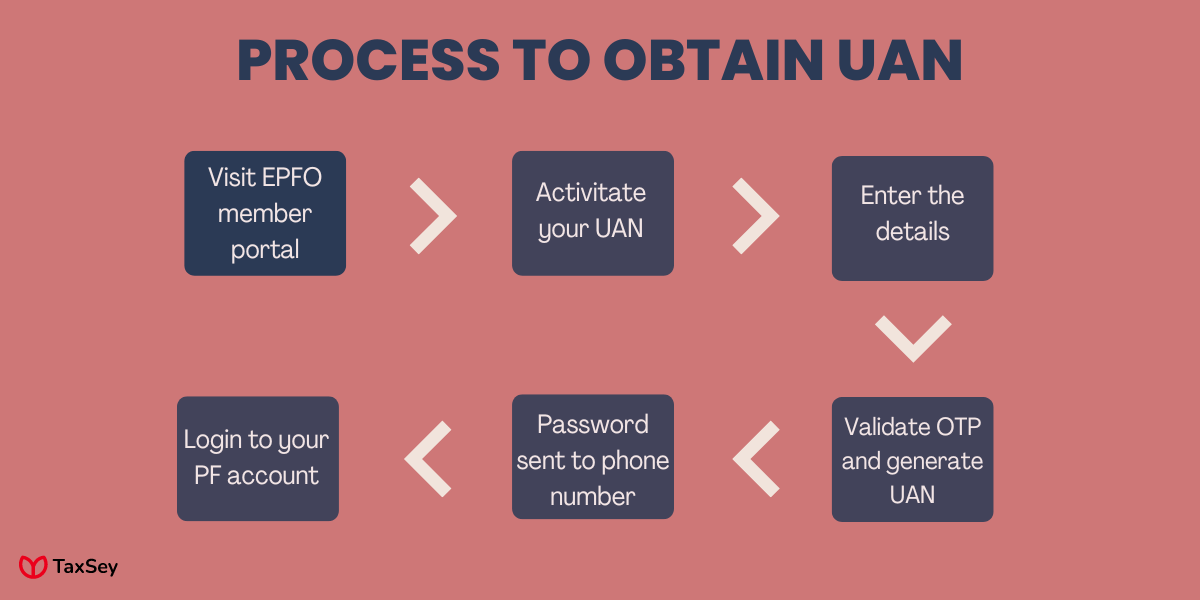

How to obtain UAN?

UAN is required to access your PF account. There are two ways to obtain a UAN.

i. Through your employer ii. Through the UAN portal

Through an employer,

Employees can obtain their UAN number by asking their employers in the office. In case of their first employment, the UAN will be intimated by the employer.

Most of the Indian companies tend to print salary slips for their workers. The salary slips will contain the UAN, from which the individuals can note it down. When you change jobs, the identification number is given by your employer.

Through the UAN portal

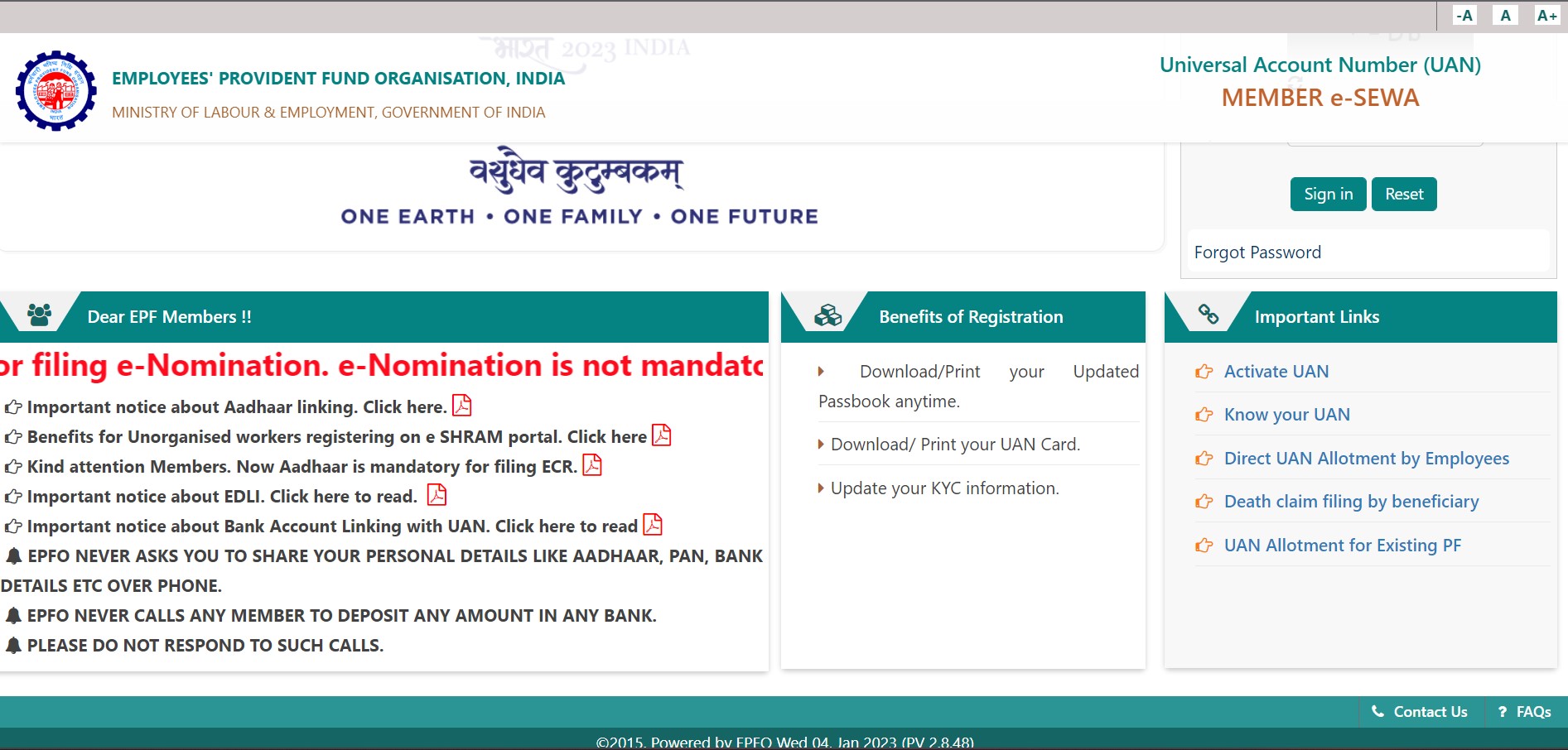

You can also find your UAN number online. All you have to do is visit the UAN portal and follow the steps to get your number, without asking your employer.

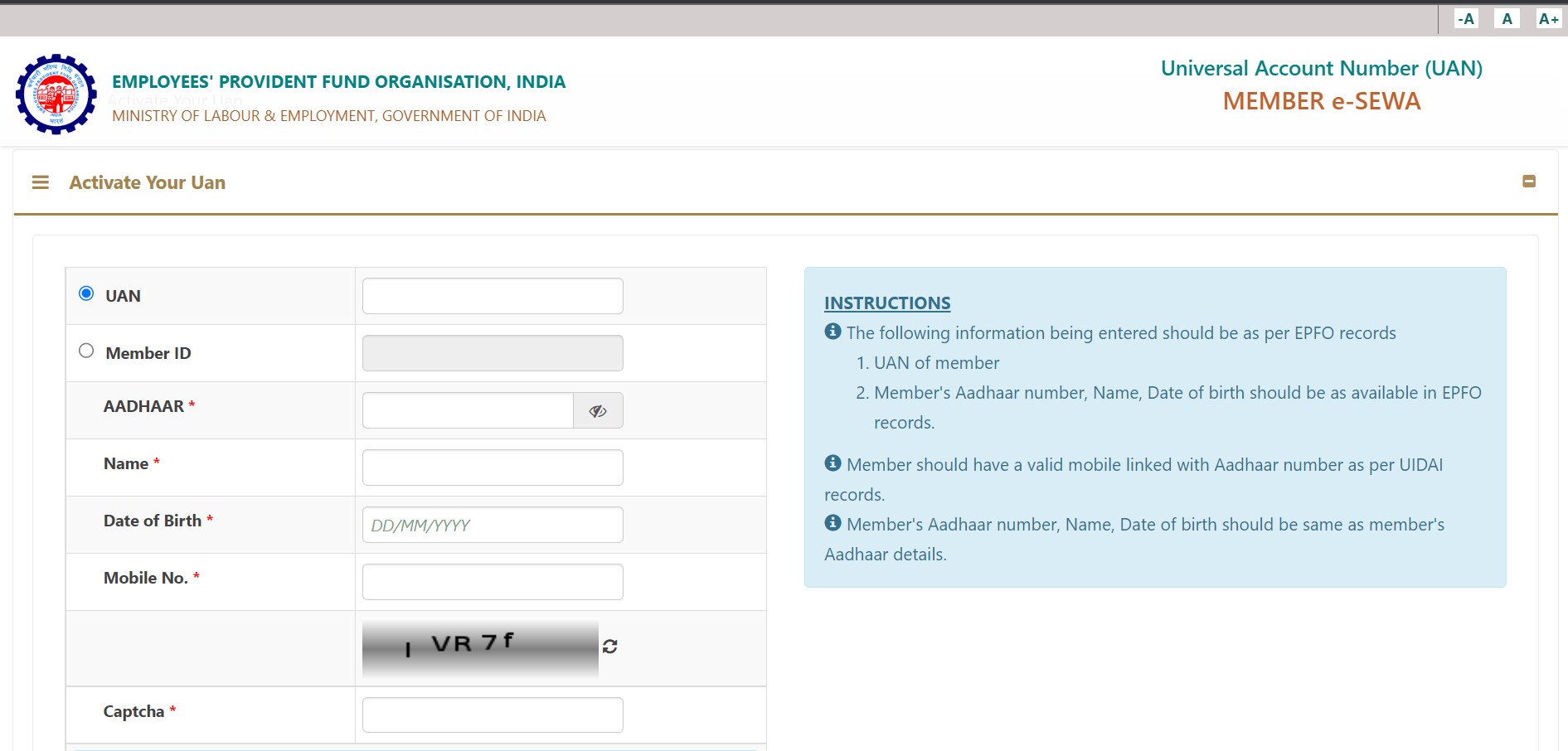

- Visit the EPFO member portal.

- Click on Activate your UAN from the right tool bar.

- Fill in the allotted member ID, along with your name, aadhar number, DOB, mobile number and captcha code.

- Click on Get authorization pin at the bottom of the page.

- The authorization pin will be sent to the registered phone number. Validate your OTP to activate your UAN.

- After the UAN is generated, a password will be sent to the registered mobile number.

- By using the UAN and password, one can login to their PF account and access the details.

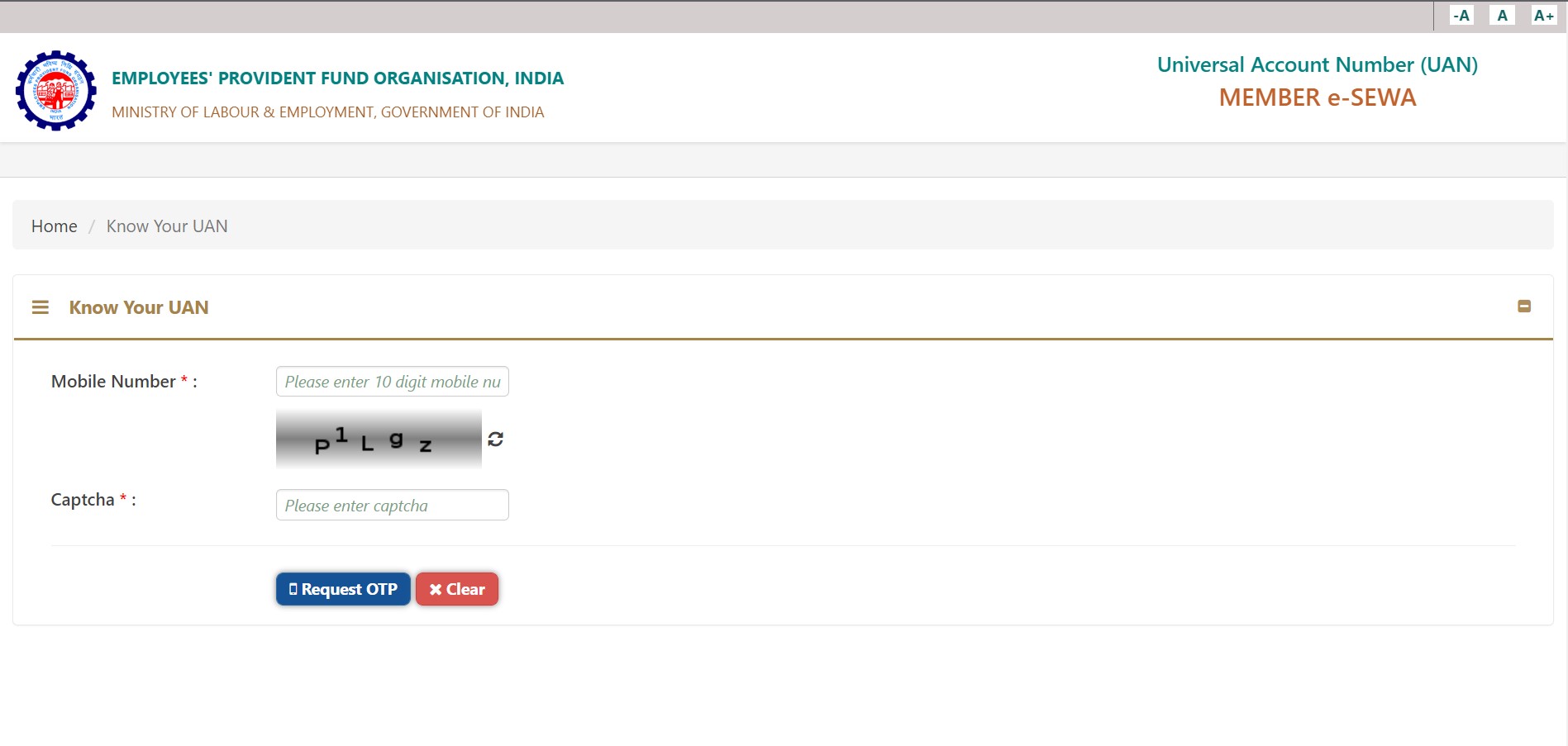

How to check UAN status?

Just after you activate your UAN, you need to check the status of the activation. This allows you to track it more easily.

- Visit the EPFO member portal.

- From the right tool bar, choose the Know Your UAN option.

- Enter the registered mobile number and the given captcha code.

- Click on Request OTP and enter the generated OTP.

- Fill in the details such as Name, DOB, aadhar, PAN, member ID and click on Show my UAN, to get the details regarding your UAN.

Documents required to obtain UAN

To obtain any type of identification number from your workplace, you need to submit a set of documents as proof. Below are the documents that are required to obtain your UAN.

• Bank details such as account number, IFSC code, and branch name.

• Your driver's license, Aadhar card, voter ID or any national card with your photo on it is valid ID proof.

• For address proof you can submit any recent utility bill, rent/lease document, ration card or any document that contains your current address.

• PAN card and Aadhar card are mandatory, because it is related to your bank details.

Benefits of UAN

• PF accounts for all working individuals are managed and maintained by UAN. Having a UAN number also has various other benefits such as,

• The number helps the government to track how many jobs an individual has changed.

• It helps to verify if the details associated with the individual are genuine to access the PF account.

• By using the UAN, employers can easily access the KYC documents of their employees.

• It facilitates online access to PF accounts.

• Every individual can track the amount that is deposited on the PF account every month.

• If an individual changes jobs, it is enough to give the UAN number to transfer all the funds from the previous work.

• If you need the PF account statement, it can be downloaded instantly by entering the UAN number.

Conclusion

Knowing their UAN is mandatory for every employee. This is because PF is one form of investment or savings that is available to every working professional. Once they have completed 20 years of employment, they can use this PF.

At the time of retirement, it is this UAN number that will provide them access to the PF account. Hence, this article will help you gain access to the UAN and know the details about the PF.

Frequently Asked Questions

UAN is Universal Account Number which is a 12 digit number that is generated by the Employee Provident Fund Organization (EPFO). This number is given to all PF account holders, which holds the details of their savings.